6: TURKISH, CYPRIOT & GREEK DEVELOPMENTS

6.1 IMF Lowers Forecast for Cypriot Economy Due to Global Slowdown

The International Monetary Fund downgraded its projections for the Cyprus economy as part of the slowdown of the global economy due to subdued trade and softer industrial production. In its World Economic Outlook (WEO), the IMF said Cypriot GDP will expand by 3.1% compared with 3.5% of GDP in its April edition, while in 2020 the economy is expected to slow at 2.9% growth compared with 3.3% in its previous estimate. Unemployment is projected to reach 8% compared with 7% in the previous estimate and decline to 6% in 2020, the IMF said. Inflation will remain subdued at 0.8% this year but accelerate to 1.6% in 2020. Cyprus’ current account will reach a deficit of 7.8% in 2019 and is estimated to decline to 7.5% in 2020. (IMF 16.10)

6.2 Cyprus Minister Warns Care Needed in Handling Toxic Loans and New Health System

Cypriot Finance Minister Georgiades warned that the three outstanding issues which must be dealt with are the elimination of non-performing loans, a pending court decision on civil service salary cuts and the sustainability of the National Health Service. Georgiades was speaking at his fifth and final annual lecture at the University of Cyprus, before stepping down as minister later this year.

He said that Cyprus needs to increase per capita income to the European average by preserving and strengthening traditional sectors of the economy and encouraging the development of new ones to expand the productive base. The Finance Minister said that during its second term the government was focusing on promoting reforms, it has budgeted hundreds of millions for e-government and created new structures and allocated significant resources to research and innovation. He also noted that the Government has brought before parliament bills providing for reforms in the judicial system, the local government, and establishing a new supervisory authority for insurances and welfare funds as well as a Ministry for Research, Innovation and Digital Policy. (FM 23.10)

6.3 Turkish Retail Sales Fall for 12th Straight Month in August

Every Cyprus resident with an income of any size is soon to be obliged by law to submit an annual income tax statement, said Finance Minister Georgiades. The Minister said that a bill has been approved by the cabinet which foresees that everyone is obliged to submit an income tax statement to enhance the state’s capacity to “exercise effective tax control”. The amendment means every citizen is legally obliged to submit a tax statement whether their annual income is under the taxable threshold of €19,500 or not. A second provision of the draft bill will see all businesses required to accept plastic money as payment. The new legislation will also make the failure to pay income tax a criminal offence, in line with VAT provisions. (FM 24.10)

6.4 Greek Unemployment Falls by 5% during September

The total number of people registered as being unemployed in Greece fell by 5.06% from August to September, the Manpower Organization (OAED) reported on 21 October. This brought the August total of 888,089 listed as unemployed down to 843,154 in September. The drop in unemployment is calculated by the criterion of actively seeking work. Concerning those who are registered as unemployed but are not seeking employment, OAED reported a drop of 4.8%, from 73,660 in August to 70,128 in September. (ANA-MPA 21.10)

6.5 Greece Slips Further in Terms of Global Competitiveness

The boards of the European Stability Mechanism (ESM) and European Financial Stability Facility (EFSF) agreed on 28 October to allow Greece to repay earlier a part of its expensive loan to the International Monetary Fund (IMF), without paying an equal amount to the two organizations. Under the ESM and EFSF loan agreements with Greece, if the country repays the IMF early, it would have to repay a proportional amount to the two institutions, but the waiver granted by the ESM and EFSF means that the country will not be required to do so. Greece’s early partial repayment to the IMF will generate savings as Greece can now finance itself on the market at a lower cost compared to the cost of servicing the tranche to be repaid to the IMF. (eKathimerini 29.10)

7: GENERAL NEWS AND INTEREST

*ISRAEL:

7.1 Eid Al Mawlid Marked by Moslems Worldwide

The Eid al Mawlid a-Nabawi is the celebration of the birth of Prophet Muhammad. While some are against any such celebration, the overwhelming majority of Muslims take part in one form or another. Shias observe the event on 17 Rabi Al Awwal, while Sunnis observe it on the 12th of the month. Some branches of Sunni Islam, such as Wahhabi and Salafi do not celebrate Mawlid, meaning that it is not a holiday in some countries such as Saudi Arabia and Qatar.

In Jordan, the Mawlid celebrations will begin on 9 November, ending on the 10th. Morocco’s Ministry of Islamic Affairs has announced that as 1 Rabi Al Awwal, the third month in the Islamic calendar will correspond to 30 October, Moroccans will celebrate the feast of the birth of Prophet Muhammad on 10 November. The month of Safar, the second month in the Islamic year, will complete 30 days and the first day of Rabi I will be on 30 October. Unlike others feasts such as Eid Al Adha and Eid al Fitr, Muslims are not supposed to perform any special prayers in the early morning. The Eid is an opportunity for Muslims to recall the ideals of Islam and recite poems dedicated to the prophet.

*REGIONAL:

7.2 Academic Studies in Israel See More Computer Science and Less Law or Humanities

According to recently released data by the Israel’s Council for Higher Education, the supervisory body for universities and colleges, between 2013 and 2018 the number of students who enrolled for computer science and math degrees has risen by approximately 53%, rising from 10,924 to 16,780.

In Israel, tech workers accounted for 8.7% of the national workforce in 2018, up from 8.3% in 2017, according to a report published in August by the government’s tech investment arm, the Israel Innovation Authority. The IIA recorded some 300,000 filled full-time tech positions in the country in 2018. By mid-2019, this number increased to 307,000. The number of students who enrolled in engineering degrees in Israel has increased by approximately 10% between 2013 and 2018, from 31,867 to 35,041.

Many multinational companies keep Israeli offices; companies including Intel, Nvidia, Amazon and Samsung have stepped up their recruitment efforts in Israel in the past year sending wages up to around 2.5 times the average local wage.

Lebanon has been paralyzed by the unprecedented wave of protests against the rampant corruption of the political class that has collectively led Lebanon into the worst economic crisis since the 1975-90 civil war. The turmoil has worsened Lebanon’s acute economic crisis, with financial strains leading to a scarcity of hard currency and a weakening of the pegged Lebanese pound. Lebanese government bonds tumbled on the turmoil. (Various 29.10)

7.3 Abu Dhabi Launches World’s First University of Artificial Intelligence

On 16 October, Abu Dhabi announced the establishment of the Mohamed bin Zayed University of Artificial Intelligence (MBZUAI), the first graduate level, research-based AI university in the world. MBZUAI will enable graduate students, businesses, and governments to advance artificial intelligence, a statement said. The University is named after Sheikh Mohamed bin Zayed Al Nahyan, Crown Prince of Abu Dhabi and Deputy Supreme Commander of the UAE Armed Forces, who has long advocated for the UAE’s development of human capital through knowledge and scientific thinking to take the nation into the future. MBZUAI will provide all admitted students with a full scholarship, plus benefits such as a monthly allowance, health insurance, and accommodation. The university will also work with leading local and global companies to secure internships, and will also assist students in finding employment opportunities. The first class of graduate students will commence coursework at MBZUAI’s Masdar City campus in September 2020.

The university will offer Master of Science (MSc) and PhD level programs in key areas of AI – Machine Learning, Computer Vision, and Natural Language Processing – while also engaging policymakers and businesses around the world so that AI is harnessed responsibly as a force for positive transformation.

8: ISRAEL LIFE SCIENCE NEWS

8.1 Fidmi Medical Receives FDA Regulatory Clearance for Low-profile Enteral Feeding Device

Fidmi Medical, a portfolio company of The Trendlines Group, announced that it received 510K regulatory clearance from the US FDA for its low-profile enteral feeding device. Fidmi Medical’s innovative low-profile gastrostomy system is unique in that it can be utilized for both initial placement and replacement and has several features which make it more durable and comfortable for patients. Gastrostomy tubes very often get dislodged or clogged, promoting infection and need to be replaced frequently. Fidmi’s improved low-profile gastrostomy tube is placed just like any standard Percutaneous Endoscopic Gastrostomy (PEG) tube but has an easily replaceable inner tube which can be changed by patients without the need to re-enter the healthcare system for replacement procedures. This will result in fewer complications with patients’ gastric tubes, therefore potentially reducing healthcare costs for payers and healthcare systems; as well as providing a substantial improvement in quality of life for patients and their caregivers.

Caesarea’s Fidmi Medical is an Israeli company founded in 2014, dedicated to developing enhanced feeding devices that offer easy insertion, replacement and removal. The Company was founded with investment and support of The Trendlines Group’s medical technology incubator, and support from the Israel Innovation Authority. Fidmi Medical is currently raising a new investment round to bring the company to commercialization. (Fidmi Medical 16.10)

8.2 AquaMaof Reveals Ground-Breaking Technology for Land-Based Shrimp Production

AquaMaof Aquaculture Technologies revealed a land-based R&D facility for the production of shrimp located in southern Israel. In an industry first, AquaMaof has successfully adapted its RAS technology to the commercial production of L vannamei shrimp with a high-survival rate and disease-free results.

To date, AquaMaof has secured more than $300 million in closed deals around the globe, leading the land-based aquaculture industry with more than a dozen facilities worldwide. AquaMaof’s RAS technology provides a solution for responsibly-farmed and harvested aquaculture practices, for fish and seafood.

AquaMaof has developed a solution after three years of research, announcing that its proprietary RAS technology for commercial land-based production of shrimp will be ready for market in 2020. AquaMaof successfully achieved high-density shrimp production, high shrimp survival rates and low FCR (Food Conversion Ratio) – all in a disease-free environment, with very low bacterial counts in the water. Additionally, AquaMaof’s technology facilitates control over the color of the shrimp and their genetics, enabling production of a high-quality end product. The technology also enables partial harvest in different sizes, while maintaining low operational costs.

Rosh HaAyin’s AquaMaof Aquaculture Technologies is a privately-owned company, specializing in the field of indoor aquaculture technology and turn-key projects. With over 30 years of experience, AquaMaof’s team of technology and aquaculture experts has been providing research and development, as well as comprehensive design, production, operations and support solutions for aqua farming in over 50 locations around the world. The Company’s unique indoor fish production capabilities offer advanced, sustainable, and cost-effective solutions for today’s fish-growing needs. From concept to operational fish production facilities, the company’s cutting-edge RAS (Recirculating Aquaculture Systems) based solutions have been proven worldwide. (AquaMaof 16.10)

8.3 Anlit Delivers Probiotics by the Bite

Anlit expanded its portfolio of family oriented dietary supplements with new, flavorful Long-Life Probiotic bites. The company has stabilized a range of probiotic strains via its innovative LLP technology, which preserves live bacteria in ambient conditions suitable for incorporation into fun and flavorful chewable bites. Anlit selected specific probiotic strains to be adapted into new formulations that target gut health, women’s health, and immune function merged with natural inulin fiber from native chicory for added prebiotic support.

The three strains currently available include: Bifidobacterium lactis, one of the main colonizers of the human intestinal microbiome throughout the life span and having a key role in boosting immunity; Lactobacillus acidophilus, the microbe of choice for protecting women’s gynecological health and preventing infections; and Lactobacillus rhamnosus-GG, known for helping to promote better gut function and for relieving IBS symptoms.

Granot’s Anlit, a subsidiary of Maabarot Products, Israel, is an innovative developer and manufacturer of a comprehensive range of food supplements for adults and children. All Anlit products are gluten-free and nut-free. The plant is certified GMP, FSSC22000, and ISO 9001 and is HACCP compliant, as well as kosher and halal certified. (Anlit 16.10)

8.4 Cannabics Clinical Data Results from Its Study on Controlled Release Capsules

Cannabics Pharmaceuticals announced that the final results of its pilot study to test the efficacy of Cannabics’ Dosage-Controlled capsules for the treatment of cancer anorexia-cachexia syndrome (CACS) in advanced cancer patients have been published on the Journal of Integrative Cancer Therapies. The study was performed at the Rambam Health Care Campus (HCC), Division of Oncology, in Haifa, Israel. The study objective was to evaluate the effect of dosage-controlled cannabis capsules on CACS in advanced cancer patients, and more specifically, on patient weight variation.

The cannabis capsules used in this study contained 2 fractions of oil-based compounds, provided by Cannabics Pharmaceuticals. All stages of the technology are being protected under Cannabics’ rapidly expanding patent portfolio. The formulation of the study capsule is a lipid-based drug delivery system, which highly improves the relatively low oral bioavailability, related to absorption, degradation and metabolism.

During the study, some patients reported several psychoactive side effects and it was decided to reduce the capsules’ dosage to 5 mg. Almost no side effects were reported with the Cannabics 5 mg dosage. It seems that this dosage is appropriate for the treatment of CACS in advanced cancer patients under active treatment. This is the first study investigating the effect of dosage-controlled cannabis capsules on CACS and, more specifically, on weight variations in advanced cancer patients, according to the Good Clinical Practice criteria.

Cannabics Pharmaceuticals is a U.S public company that is developing a platform which leverages novel drug-screening tools and artificial intelligence to create cannabinoid-based therapies for cancer that are more precise to a patient’s profile. By developing tools to assess effectiveness on a personalized basis, Cannabics is helping to move cannabinoids into the future of cancer therapy. The company’s R&D is based in Israel, where it is licensed by the Ministry of Health to conduct scientific and clinical research on cannabinoid formulations and Cancer. (Cannabics 16.10)

8.5 Intelerad & Zebra Medical Vision Accelerate AI Adoption via Intelerad’s Odyssey Workflow

Montréal, Québec’s Intelerad Medical Systems, a leader in enterprise workflow solutions, and Zebra Medical Vision announced a joint program leveraging Intelerad’s newly released Odyssey designed to encourage the adoption of artificial intelligence without the prohibitive costs usually associated with such programs. Odyssey harnesses the power of artificial intelligence and the technology behind the Intelerad worklist to offer an unparalleled workflow management solution, comprised of the clinical AI engine, powered by Zebra-med’s AI1 “all-in-one” bundle of FDA cleared AI applications. Connected via API, it analyses the images and automatically returns the findings to the worklist which then escalates the study to the radiologist’s attention.

With Odyssey, Intelerad and Zebra-Med are removing two critical barriers to AI accessibility: the prohibitive cost of AI platforms and the need for demonstrated impact prior to committing resources to AI. Through a pay-per-study model and by eliminating the high, up front flat-fee models typically offered in the market, Intelerad intends to encourage AI adoption by healthcare service providers of all sizes. Therefore, for a limited time, Intelerad will subsidize and secure for its customers 12 months of trial use of the AI1 clinical algorithms.

Kibbutz Shefayim’s Zebra Medical Vision‘s Imaging Analytics Platform allows healthcare institutions to identify patients at risk of disease and offer improved, preventative treatment pathways to improve patient care. Zebra-Med, founded in 2014, is funded by Khosla Ventures, Marc Benioff, Intermountain Investment Fund, OurCrowd Qure, Aurum, aMoon, Nvidia, J&J, and Dolby Ventures. (Zebra Medical Vision 21.10)

8.6 Perflow Medical Receives CE Mark Approval of Novel Cascade Agile

Perflow Medical has received CE Mark approval for the Cascade Agile Non-Occlusive Remodeling Net (Cascade Agile). Expanding the Cascade product family, the Cascade Agile optimizes control for distal and tortuous vessel anatomy during coil embolization of intracranial aneurysms. The Cascade Agile is the latest addition to Perflow’s portfolio of novel neurovascular devices based on a proprietary technology platform, which includes the Stream Dynamic Neuro-Thrombectomy Net (Stream Net) and Cascade Net.

The Cascade product family enables procedural efficiency that is not seen in competitive remodeling devices that necessitate total or partial vessel occlusion. Their unique net design enables continuous blood flow during cerebral aneurysm repair and coiling. For distal aneurysms with tortuous anatomy, the Cascade Agile’s shorter braid length creates an even more responsive device, which gives physicians the confidence and control they need to safely perform coil embolization. The Cascade product family and Stream Net are commercially available across Europe for the treatment of intracranial aneurysms and acute ischemic stroke, respectively. Perflow products are not approved for clinical use within the United States.

Netanya’s Perflow Medical develops and manufactures innovative solutions to address complex neurovascular disorders. Perflow’s patent protected CEREBRAL NET Technology platform, a braided net that enables adjustable neurovascular treatments, emphasizes physician expertise by combining real-time physician control, advanced device manipulation, full wall apposition, and excellent radiopacity to improve patient outcomes. (Perflow Medical 21.10)

8.7 Thai Union Group Invests in Alternative Protein Startup Flying SpArk

Flying SpArk and Thailand’s Thai Union Group, one of the world’s largest seafood producers, are leveraging their expertise and capabilities to develop an important entry in the alternative protein market. Thai Union will also invest in Flying SpArk, enabling the startup to move ahead with its insect growing and processing capabilities in Thailand and dedicate efforts towards cost reduction and process improvements. The Flying SpArk and Thai Union announcement includes both a strategic partnership and investment to promote larval insect protein as a highly sustainable, highly nutritious contender in the alternative protein market. This collaboration joins Thai Union’s production capabilities and global reach with Flying SpArk’s innovative technology in creating an affordable protein offering to fulfill the worldwide growing need for cheap, sustainable, high-quality protein.

Flying SpArk uses larvae from Ceratitis Capitata, which in nature feed on fresh fruits. The larvae have a lifespan of only seven days yet multiply their body mass 250 times in that period. Flying SpArk’s technology enables easy and low cost cultivation and processing, with nearly zero waste, as all parts of the larvae are used. This gives Flying SpArk an edge over conventional protein sources — not only those from meat and plants but also over other insects, such as crickets and grasshoppers.

Ashdod’s Flying SpArk is producing 70% protein powder that is extremely rich in iron, calcium, magnesium, dietary fibers, and is an excellent source of amino acids. Its white color and mild taste and aroma enables easy incorporation of the protein into a variety of food and feed products. The protein production process is highly sustainable; Flying SpArks’ technology requires very little water and land, creates no methane emissions, and does not use hormones or antibiotics. The startup received its seed investment, and is supported by, the Israeli FoodTech incubator “The Kitchen Hub”, a part of the Strauss Group Ltd., the second largest food producer in Israel. (Flying SpArk 22.10)

8.8 Orasis’ CSF-1 Eye Drop Meets Primary Endpoint in Presbyopia Study

Orasis Pharmaceuticals announced its CSF-1 eye drop has successfully met the primary endpoint in a Phase 2b clinical study in individuals with presbyopia. CSF-1 successfully demonstrated statistically significant improvement in distance-corrected near visual acuity of a 3-line or greater gain. In addition, CSF-1 demonstrated an exceptional safety and tolerability profile. Full results from the study will be submitted for presentation at an upcoming medical meeting. The Phase 2b study (NCT03885011) was a multi-center, double-masked clinical trial that evaluated the efficacy and safety of CSF-1 in 166 participants across several research centers in the U.S.

Presbyopia is the inability to focus on near objects. It commonly occurs after the age of 40 and affects more than 1.8 billion people worldwide. People with presbyopia experience blurred vision when performing daily tasks that require near visual acuity, such as reading a book, a restaurant menu or messages on a smartphone. Presbyopia occurs as a result of the natural aging process when the crystalline lens of the eye gradually stiffens and loses flexibility. Presbyopia cannot be prevented or reversed, and it continues to progress gradually. All existing treatment options are either cumbersome or invasive, presenting a significant unmet need for quality of life improvement for people with presbyopia.

Herzliya’s Orasis Pharmaceuticals is developing CSF-1, a corrective eye drop for the treatment of presbyopia as an alternative to reading glasses. By repurposing existing and well-studied molecules, CSF-1 is designed to be effective, safe, comfortable and easy-to-use. Orasis is led by a collaborative team of industry executives and ophthalmologists with a diverse set of experiences in research, development, and commercialization of pharmaceutical drugs, as well as finance and business development. (Orasis 20.10)

8.9 Viz.ai Raises $50 Million Series B Round for AI Powered Synchronized Stroke Care

Viz.ai announced a $50 million Series B funding. The funding round was led by Greenoaks with participation from Threshold Ventures, CRV along with existing investors GV and Kleiner Perkins. Viz.ai has emerged as one of the most exciting and fastest growing healthcare companies in the artificial intelligence (AI) space. Through the De Novo FDA pathway, Viz.ai introduced the concept of computer-aided triage software; Viz uses deep learning algorithms to identify a suspected large vessel occlusion, a particularly disabling type of stroke, in a CT scan and alerts the stroke team specialist. This happens in minutes. By alerting the right doctor at the right time and synchronizing care, Viz has the potential to significantly reduce the time to treatment and greatly increase a patient’s chances of a good outcome.

Viz.ai’s acute ischemic stroke software is now available in over 300 hospitals across the U.S. Viz.ai is positioned to make a big impact on healthcare as a whole by curating the exponentially expanding healthcare data and making it immediately actionable for medical providers.

Tel Aviv’s Viz.ai is the leader in applied artificial intelligence in healthcare. Viz.ai’s mission is to fundamentally improve how healthcare is delivered in the world, through intelligent software that promises to reduce time to treatment and improve access to care. Viz.ai’s flagship product, Viz LVO, leverages advanced deep learning to communicate time-sensitive information about suspected stroke patients straight to a specialist who can intervene and treat. (Viz.ai 23.10)

8.10 Teva Settles Track 1 Opioid Cases and Reaches Agreement on Settlement Framework

Teva Pharmaceutical Industries and its affiliates announced a settlement agreement with both Cuyahoga and Summit counties of Ohio. The settlement resolves the counties’ claims and removes Teva from the Track 1 opioid litigation. Under the terms of the settlement, the Company will provide the two counties with the critical opioid treatment medication buprenorphine naloxone (sublingual tablets), known by the brand name Suboxone, valued at $25 million and distributed over three years to help in the care and treatment of people suffering from addiction, with a cash payment in the amount of $20 million, to be paid over three years.

Teva also confirms that there is an agreement in principle with a group of attorneys general from North Carolina, Pennsylvania, Tennessee and Texas, as well as certain defendants, for a global settlement framework. The framework is designed to provide a mechanism by which the Company attempts to seek resolution of remaining potential and pending opioid claims by both the states and political subdivisions. Under this agreement, Teva would donate buprenorphine naloxone (sublingual tablets), in quantities of up to the amount needed to meet the majority of the currently estimated U.S. patient need over the next 10 years, with a value of approximately $23 billion. The Teva product donation will significantly contribute to the care and treatment of people suffering from addiction and assist impacted communities. Teva would also provide a cash payment of up to $250 million over 10 years.

Teva Pharmaceutical Industries has been developing and producing medicines to improve people’s lives for more than a century. They are a global leader in generic and specialty medicines with a portfolio consisting of over 3,500 products in nearly every therapeutic area. Around 200 million people around the world take a Teva medicine every day, and are served by one of the largest and most complex supply chains in the pharmaceutical industry. (Teva 21.10)

8.11 Biomica & Weizmann Develop a Treatment Against Antibiotic Resistant Bacteria

Biomica announced a collaboration with the Weizmann Institute of Science to develop a selective treatment against antibiotic resistant strains of Staphylococcus aureus infection, in a microbiome focused approach. This approach aims to target a specific microbe while maintaining the microbiome of the patients’ gut. The company has in-licensed discoveries in high-resolution crystal structure of the large ribosomal subunit of the pathogenic Staphylococcus aureus. The crystal structure originates from pathogenic species, allowing a high degree of specificity, and together with Biomica’s unique computational technology, will enable the design and development of new types of selective, narrow spectrum antibiotics agents.

Biomica aims to use the in-licensed IP and know-how to design specific molecules that selectively target and inhibit the large ribosomal subunit of the pathogenic Staphylococcus aureus. Biomica utilizes a unique computational approach, licensed from Evogene (the CPB platform), for a virtual screening process that enables the identification and design of small molecular agents with selective activity towards specific microbial target proteins. While current broad-spectrum antibiotics treatments harm the patient’s commensal intestinal microbial community, Biomica’s highly selective approach aims to target and eliminate only the pathogen and maintain the integrity of the patients’ gut microbiome.

Rehovot’s Biomica is an emerging biopharmaceutical company developing innovative microbiome-based therapeutics utilizing a dedicated Computational Predictive Biology platform (CPB). Biomica aims to identify and characterize disease-related microbiome entities, and to develop novel therapeutics based on these understandings. The company is focused on the development of therapies for antibiotic resistant bacteria, immuno-oncology and microbiome-related gastrointestinal (GI) disorders. (Biomica 23.10)

8.12 MedHub’s AI-Powered Solutions are Disrupting Cardiology

Tel Aviv’s MedHub develops decision-support systems for cardiologists that leverage Artificial Intelligence (AI) to guide cardiologists during the diagnostic cardiac angiography process. The fully automated system, named AutocathFFR, detects stenoses (narrowing) in the coronary arteries surrounding the heart, while providing cardiologists with relevant physiological parameters that aid them in assessing the severity of their patients’ condition. In doing so, the system helps these physicians devise the optimal treatment strategy.

Following a successful feasibility study, done in close collaboration with the Rambam Healthcare Campus, a leading facility in the field of interventional cardiology, MedHub is now in the initial stages of a pivotal multi-center clinical trial to demonstrate the efficacy of AutocathFFR. The results of the feasibility study will be published at the upcoming, highly prestigious, ICI conference.

MedHub considers its first product, AutocathFFR, part of the current movement towards automizing medical practices. With the advent of AI, the road to full Robotic Process Automation (RPA) in cardiac diagnostics is getting shorter. MedHub has goaled itself with optimizing diagnoses, thus lowering costs, improving the long-term effects of treatment and achieving better overall outcomes in terms of quality of life. (MedHub 22.10)

8.13 Pepticom Raises $5 Million in Series A Funding

Pepticom has secured $5 million in Series A funding from the Chartered Group. Pepticom’s unique artificial intelligence (AI) technology streamlines and significantly accelerates the ability of researchers to discover advanced peptide-based drug candidates. Peptides are used in various therapies, and are recognized for being highly selective and efficacious as well as relatively safe. The pharma industry has recently shown an increased interest in peptide research and development, leading to a resurgence of peptide drug candidates. The process of discovering new peptides with lifesaving potential, however, is still costly and time consuming. Pepticom’s AI technology enables the discovery of the most advanced peptide-based drug candidates by searching an enormous set of possible solutions, vastly reducing the risk of failure during development.

Pepticom’s technology covers a chemical-space of 1030 possible molecular options – which is much larger than current screening techniques – while simultaneously filtering out the most suitable candidates with properties such as solubility and permeability amongst others. The ability to search a large amount of variables while considering their pharmacological impact, and also eliminating nonviable molecules at an early stage is groundbreaking in peptide drug discovery. Pepticom’s technology brings down the cost of drug discovery in a quick, comprehensive and successful manner.

Jerusalem’s Pepticom is a privately held AI company committed to offering AI peptide drug discovery solutions for a better and healthier world. It is the leader in the emerging peptide drugs software solutions, AI and prediction tools that allow research centers, pharma and agriculture companies to accelerate innovative molecules discovery while reducing time, costs and risks. Pepticom operates in various markets; past successful discoveries include peptide molecules related to metabolic diseases and Immuno-modulators. Pepticom was founded in 2011 by a select team of multidisciplinary PhD graduates from The Hebrew University of Jerusalem with technology licensed from Yissum, the technology transfer company of The Hebrew University. (Pepticom 24.10)

8.14 Biogal-Galed Labs Launches RoboComb, an Automated Kit Reading Device

Biogal Galed Labs, a leader of veterinary diagnostic solutions, announced the commercialization of the new RoboComb, an automated development robot for Biogal’s VacciCheck and ImmunoComb kits. This will make the development of VacciCheck / ImmunoComb simple, faster, automated and more accurate.

This user friendly, add on technology, will greatly assist veterinarians in the vet clinic / vet lab setting.

RoboComb now offers automated development of ImmunoComb/VacciCheck, “Walk away” operation of ImmunoComb /VacciCheck results, equivalency to a lab ELISA robot, less chance of development errors, when compared to manual development and can individually or batch test up to 12 teeth. When adding RoboComb to Biogal’s recently released CombCam, both the development and interpretation of VacciCheck or ImmunoComb, is now a fully automated process. The RoboComb is available for all of Biogal’s VacciCheck/ImmunoComb kits.

Kibbutz Galed’s Biogal was established in 1986. Biogal’s various veterinary diagnostic products are available in over 35 countries. Biogal developed the patented ImmunoComb, VacciCheck and PCRun technologies for the detection of pet infectious diseases. (Biogal Galed Labs 28.10)

8.15 Laminate Medical Receives Investment from Valiance

Laminate Medical Technologies announced the completion of a capital raising following an investment from the London-based Valiance Asset Management, through its Luxembourg domiciled Life Sciences Global Investment Fund, in addition to the investment announced earlier this year. This is the first investment by a Valiance fund in an Israeli company.

Laminate’s flagship device, VasQ, is in use today in hundreds of hospitals across Europe with impressive results. Dialysis patients require surgically created arteriovenous fistulas to facilitate renal replacement therapy. However, arteriovenous fistulas have a historically high primary failure rate, requiring patients to experience multiple additional procedures or even to receive an entirely new arteriovenous fistula. VasQ’s unique design provides an external support for the fistula to promote usability without the need for multiple procedures and minimizes the risk of primary failure requiring a new creation. The success of VasQ has been demonstrated in a recently published randomized controlled study in the American Journal of Kidney Disease, as well as by independent reports from commercial use.

VasQ has already received European CE approval and is commercialized locally by means of a broad network of distributors in Italy, Switzerland and Austria. There has been significant uptake in Germany following approval of NUB insurance indemnification, regulating receipt of authorized reimbursements from the country’s insurance companies to cover the cost of the device. The research and development center of Laminate Medical Technologiesis in Ramat HaHayal in Tel Aviv, with branches in the USA and Germany. The company has 22 employees. (Laminate Medical 23.10)

8.16 BASF and NRGene Collaborate to Accelerate Crop Breeding

Germany’s BASF and NRGene announced a research collaboration that includes the adoption of NRGene’s cloud-based artificial intelligence (AI) technology into BASF soybean research projects. The GenoMAGIC technology will allow for more comprehensive evaluations to accelerate trait discovery and breeding across diverse crops.

NRGene’s advanced multi-purpose breeding platform is a cloud-based solution for managing the full genomic diversity of species. It can analyze unlimited volumes of genomic data, enabling scientists and breeders to easily relate genomic sequences with beneficial traits, making genomic selection and trait mapping much more productive. Data use is accelerated, making breeding both faster and more cost effective

Rehovot’s NRGene is a genomics company that provides turn-key solutions. Relying on a vast proprietary database and AI-based technologies, we provide the largest seed and food companies in the world with the computational tools they need to maximize their crop yield, significantly saving them time and cost. NRGene’s tools have already been implemented by some of the leading agri-biotech companies worldwide, as well as the most influential research teams in academia. (BASF 29.10)

9: ISRAEL PRODUCT & TECHNOLOGY NEWS

9.1 ASOCS Launches CYRUS 2.0, an All-software 4G & 5G Virtual RAN Solution

ASOCS is launching CYRUS 2.0, the company’s newest, highly promising 4G & 5G virtual RAN solution. CYRUS 2.0 is a fully virtualized RAN solution, delivering 4G & 5G cellular connectivity in a single software stack. CYRUS 2.0 is the first commercial-grade solution to fully support the O-RAN 7.2 front haul interface. As such, it can connect to any O-RAN 7.2 compliant radio to deliver cellular connectivity across various use cases in both LAN and WAN deployment scenarios. Fully virtualized across all layers, CYRUS 2.0 can run on any standard server or uCPE. This gives customers the ability to run multiple applications on a unified, lightweight platform. Customers can also choose whether to bring their own hardware, significantly reducing costs and time to market, or enjoy an end-to-end solution with radios, servers and all other hardware included, configured and validated.

Interoperable with VMware’s vCloud NFV platform, CYRUS 2.0 was designed with mobile operators and their enterprise customers in mind, with the goal of delivering seamless, pain-free 4G & 5G cellular connectivity and hosting multiple services both on premise and on the edge.

Rosh HaAyin’s ASOCS is disrupting the traditional RAN market with an open and virtualized software solution, delivering 4G and 5G for both LAN and WAN cellular network solutions. Their on premise mobile clouds are delivered on commercial off-the-shelf IT hardware and O-RAN compliant radios, which allow operators and their customers to benefit from new levels of performance and reliability for delivering mission-critical tasks and localized private networks. It also provides enhanced insights and analytics about mobile usage. (ASOCS 16.10)

9.2 Sonarax and GEM Bring Ultrasonic Tech-Powered Wayfinding to Museums

Sonarax announce a partnership with GEM to enhance visitor experience with indoor positioning, wayfinding, and interactive displays. GPS navigation may lead you to the museum itself, but it only drops you off at the front door. Sonarax’s ultrasonic technology, delivered through GEM’s app, picks up the slack, assisting visitors with indoor positioning to help them navigate from exhibit to exhibit at ease. Once they’ve reached each exhibit, visitors will be able to interact with the displays through their mobile phones — no Wi-Fi or mobile data required. Furthermore, when entering a specific room, the visitor will be able to see the relevant items on their mobile phone and select the relevant audio description. Sonarax’s technology, which communicates data through soundwaves, makes it possible, offering visitors a seamless and reliable user experience.

Haifa’s Sonarax is a deep tech technology company, which develops the most advanced “Data over Sound” protocol enabling ultra-secure Machine-to-Machine connectivity. The protocol empowers Location-Based-Services from marketing to P2P payment, access control, IoT connectivity, off-line user engagement, and unique indoor navigation. Sonarax’s award-winning, unique, and proprietary IP is well recognized by leaders in the academy and industry.

Tel Aviv’s GEM is a personalized mobile app for visitors in museums that creates a relationship between museums and their audiences before, during, and after their visit. GEM uses AI and big-data analytics to transform each tour into a unique and memorable experience. (Sonarax 16.10)

9.3 Odo Security Named Top Hot Startup Winner in 2019 NetEvents Awards

Odo Security was selected the overall Hot Startup winner in the prestigious 2019 NetEvents Innovation Awards, held at the Hayes Mansion in San Jose, California on 3 October 2019. Each year, the NetEvents Innovation Awards honor the most innovative startups and established companies in three categories: Cybersecurity, Internet of Things (IoT) and Cloud/Datacenter. In addition to being named the Hot Startup winner in the Cybersecurity category, Odo Security also received the most votes from venture capital judges as their top investment choice.

Odo’s zero-trust architecture moves access decisions from the fading network perimeter to individual devices, users, and applications where business-driven security policies and access controls are best enforced. Every access attempt is treated as suspect until authenticated and authorized. Users only have access to those resources they have been authorized to see. In a new reality defined by the cloud, mobility, and increasing demands for agility, IT and DevOps engineers can ensure that the right people have access to the right resources at the right time, all while giving users frictionless access and maintaining total visibility on all user activity.

Tel Aviv’s Odo enables organizations to simplify, secure and scale remote access across multi-cloud and on-premises infrastructures. Odo’s agentless, zero trust access solution removes the need for VPNs and enables IT and DevOps engineers to easily manage secure access to any application, server, database, and environment, eliminating network layer access and providing full visibility on all user activity. (Odo Security 16.10)

9.4 Personetics’ AI-powered Engagement Platform for SMBs Adopted by Leading Banks

Personetics has been seeing a growing demand for tools designed specifically to meet the needs of banks’ small and medium business (SMB) customers. Notably, Personetics Self-Driving Technology has been critical to the digital SMB services recently rolled out by two leading banks, the Royal Bank of Canada and UK-based Metro Bank, which are using the tools to provide personalized insights, assist in cash flow management, and offer proactive advice.

Using Personetics’ technology, banks can create personalized and real-time solutions to generate tips and alerts for SMB customers, providing valuable financial insights, enabling businesses to make more data-driven decisions and grow their businesses. The new suite of tools is helping small businesses proactively manage their day-to-day banking needs, optimize cash flow, and ensure they have enough liquidity to support future growth, all in a seamless and easy to use platform. The solution enables business owners and managers to stay in control of their financial affairs anytime, anywhere as it is integrated into the bank’s online and mobile experience.

Givatayim’s Personetics

is the leading provider of customer-facing AI solutions for financial services and the company behind the industry’s first Self-Driving Finance platform. Harnessing the power of AI, Personetics’ Self-Driving Finance

platform. Harnessing the power of AI, Personetics’ Self-Driving Finance solutions are used by the world’s largest financial institutions to transform digital banking into the center of the customer’s financial life – providing real-time personalized insight and advice, automating financial decisions, and simplifying day-to-day money management. Serving over 60 million bank customers worldwide, Personetics has the largest direct customer impact of any AI solution provider in banking today. (Personetics 16.10)

solutions are used by the world’s largest financial institutions to transform digital banking into the center of the customer’s financial life – providing real-time personalized insight and advice, automating financial decisions, and simplifying day-to-day money management. Serving over 60 million bank customers worldwide, Personetics has the largest direct customer impact of any AI solution provider in banking today. (Personetics 16.10)

9.5 Wes-Tex Chooses ECI and Edge Team to Upgrade Network Capabilities

ECI and Texas’ Edge Team Technology, the premier solutions provider for information infrastructure, security, and performance management, announced that they have been chosen by the Wes-Tex Telephone Cooperative, a leader in telecom services for western Texas, to upgrade the company’s optical and IP infrastructure to latest generation technologies which will serve them for years to come.

In this latest network upgrade, Wes-Tex was able to leverage its existing ECI infrastructure to modernize its legacy optical and IP networks. Wes-Tex chose to migrate to ECI’s Apollo optical solutions and Neptune packet solutions. These solutions were built to interwork seamlessly, and both are managed simply with ECI’s industry-leading network management system (NMS), which provides multi-layer, end-to-end network management through an intuitive, point-and-click user interface.

Petah Tikva’s ECI is a global provider of ELASTIC network solutions to CSPs, critical industries, and data center operators. With the advent of 5G, IoT, and smart everything, traffic demands are increasing dramatically, and network operators must make smart choices as they evolve their infrastructure. ECI’s Elastic Services Platform leverages our programmable packet and optical networking solutions, along with our service-driven software suite and virtualization capabilities, to provide a robust yet flexible solution for any application. (ECI Telecom 16.10)

9.6 Foretellix Announces 200th Download of Its Open Scenario Description Language

Foretellix announced that 200 engineers from 130 companies and universities have now downloaded its recently opened Measurable Scenario Description Language (M-SDL). M-SDL is the first open language that addresses multiple shortcomings of today’s formats, languages, methods and metrics used to verify and validate ADAS and autonomous vehicles (AV), and address the industry mandate for ‘measurable safety.’ By opening and contributing M-SDL, tool vendors, suppliers and developers will be able to 1) use a common, human readable, high level language to simplify the capture, reuse and sharing of scenarios, 2) easily specify any mix of scenarios and operating conditions to identify previously unknown hazardous edge cases, and 3) monitor and measure the coverage of the autonomous functionality critical to prove AV safety, independent of tests and testing platforms.

Version 0.9 of the M-SDL specification was recently made available for registration, download and feedback from engineers evaluating and using the language. In the first month of industry availability, the number of downloads has reached 200. More specifically, 200 engineers downloaded the specification from 130 companies, regulatory bodies, universities, and research institutes. This includes 20 OEMs, Tier 1s and large dedicated AV developers.

Tel Aviv’s Foretellix was founded by a team of pioneers in measurable verification and validation, with a highly automated and proven coverage driven methodology broadly adopted in the semiconductor industry. They have adapted and tailored their approach for the safety verification and validation of autonomous vehicles. Foretellix’s mission is to enable ‘measurable safety’ of autonomous vehicles, enabled by a transition from ‘quantity of miles’ to ‘quality of coverage.’ Foretellix’s Foretify Technology includes an open, high level Measurable Scenario Description Language (M-SDL), intelligent and scalable automation, analytics and metrics. This includes the functional coverage metrics required to make a compelling ‘safety case’ to consumers, developers, insurance companies and regulators. (Foretellix 21.10)

9.7 OriginGPS Unveils Dual Frequency GNSS Module with Broadcom’s L1+L5 Chip

OriginGPS announced its first dual-frequency GNSS module, the ORG4600-B01. This new module will enable customers to build solutions with sub-1m accuracy without implementing external components. Measuring just 10×10 mm, the ORG4600-B01 module supports L1 + L5 GNSS reception with one RF port, enabling the use of a low-cost, dual-band antenna delivering sub-1m accuracy performance in real-world operating conditions. An alternate build option allows for separate L1/L5 RF outputs when dual antennas are required. The ORG4600-B01 is ideally suited for solutions requiring ultra-accurate positioning, such as telematics, IoT and OBD applications.

Airport City’s OriginGPS develops fully-integrated, miniaturized GNSS, and integrated IoT solutions. The ultra-sensitive, reliable, high performance modules have the smallest footprint on the market. Our cellular IoT system, OriginIoT, was recently selected by the European Commission for funding from the Horizon 2020 project. The OriginIoT functions as a platform to accelerate IoT product development with open source software and no required embedded code, RF/hardware design. OriginGPS innovative products support a wide range of verticals, such as asset tracking, law enforcement, precision agriculture, consumer IoT, fleet management, smart cities, healthcare, industrial IoT, wearables and pet/people tracking. (OriginGPS 21.10)

9.8 IoT Devices Can Now be Activated by Voice Commands – Even When Offline

With IoT in mind, the Onvego voice solution was made. Onvego’s voice assistant solution can run efficiently off-line, even on small CPUs. Moreover, the industrial environment is noisy by nature. Many people are often speaking in the vicinity of the device. The Onvego solution can identify one speaker voice from another, while disregarding the environmental noises in the background. In addition, the Onvego solution’s ability to run on private cloud, adds to its stringent security. The importance of voice solutions for IoT can be felt in everyday life. For example, it enables doctors to focus on patients, while leveraging different medical devices. It can also assist the elderly population to operate digital home appliances. Elderly people can usually say what they want the device to do, but they are sometimes unable to find the right buttons to make it work.

The Onvego voice solution already has customers and on-site implementations. It runs on both fixed and mobile devices. Additional capabilities include supporting different languages and accents, effective machine learning used for quick training in enterprise contents, as well as specific functions for building effective voice control and verbal dialogue if needed.

Onvego is a Tel Aviv-based AI technology startup company, specializing in the field of smart voice, speech and language processing. The development of the company’s technologies is based on AI algorithms and the company’s original ideas, created in recent years by its expert team. The huge growth of the IoT market, along with the productivity of voice-controlled interfaces are promising to contribute to the success of the IoT revolution of the 2020s. (Onvego 21.10)

9.9 Polte and Altair Semiconductor Embed Location Services on Cellular IoT Chipset

Dallas, Texas’ Polte Corporation, a leading innovator in accurate Cloud Location over Cellular (C-LoC) technology, and Altair Semiconductor announced a collaboration to integrate Polte’s cellular-based location technology with Altair’s ALT1250 cellular IoT chipset. The ALT1250 is Altair’s dual-mode CAT-M& NB-IoT solution. It is the market’s smallest and most highly integrated commercially available cellular IoT chipset, featuring ultra-low power consumption, GNSS location positioning, a hardware-based security framework and an RF front-end supporting all commercial LTE bands. Enabling miniature module sizes of less than 100 square millimeters, the ALT1250 is ideally suited for a range of industrial and commercial IoT applications.

Hod HaSharon’s Altair Semiconductor, a Sony Group Company, is a leading provider of Cellular IoT chipsets. The company’s flagship ALT1250 is the smallest and most highly integrated LTE CAT-M and NB-IoT chipset, featuring ultra-low power consumption, hardware-based security, and a carrier-grade integrated SIM (iUICC), all 5G ready. (Polte 22.10)

9.10 Newsight Imaging Launches the NSI1000 Sensor for Automotive Vision Applications

Newsight Imaging launched its first area sensor chip, the NSI1000, a game changing solution for machine vision, automotive, and industrial machine vision applications. The new chip, with samples available by the end of 2019, was specifically designed to support high‑volume and high-performance applications. Newsight Imaging has already started collaborating with selected customers specializing in automotive applications (multi‑channel Lidars for advanced driver-assistance systems (ADAS), Driver Monitoring Systems (DMS), Smart Mirrors), and other high volume applications requiring accurate 3D face recognition but that does not violate user privacy. Parental controls for internet and television content is one example.

The NSI1000 chip, featuring up to 50,000 frames per second (on the line resolution), fully supports Newsight Imaging’s enhanced Time Of Flight (eTOF) technology that enables the customer to employ a low-power eye-safe laser, with a resolution of 1024X32 pixels, a multi-triangulation option and also supports line triangulation with a resolution of up to 2048 pixels. The chip is a full system, including 10 bit A2D, and Newsight’s hardware implemented features, such as auto-exposure and integrated peak detection hardware circuit. The chip can work in different modes, frame by frame, and change mode from range detector to a regular camera or to illumination sensor on-the-fly, simply by software programming.

Ness Ziona’s Newsight Imaging develops advanced CMOS image sensor chips that deliver 3D solutions for high‑volume markets. The chip’s sensor is manufactured using CMOS technology with ultra-high sensitivity pixels, replacing more expensive CCD sensors and other camera modules in LiDAR applications for robotics and automotive (ADAS and Car safety) applications as well as in other markets, such as mobile depth cameras, AR/VR, Industry 4.0 and barcode scanners. (Newsight Imaging 28.10)

9.11 Secret Double Octopus Brings FIDO2 Passwordless Security to the Enterprise

Secret Double Octopus has received FIDO2 certification for its Octopus Authentication Server v4.0, including support for Active Directory on-premises. FIDO2 is a set of standards that enables easy and secure logins to websites and applications via biometrics, mobile devices and/or FIDO Security Keys. FIDO2’s simpler login experiences are backed by strong cryptographic security that is far superior to passwords, protecting users from phishing, all forms of password theft and replay attacks. Octopus Authentication Server introduces strong passwordless security across all enterprise use cases, assuring users never need to reset or memorize passwords. The new certified solution enables FIDO-based passwordless access to Workstations and servers, Active Directory resources, Cloud services and Single Sign On, Remote access (VPN & VDI) and Legacy Applications.

Tel Aviv’s Secret Double Octopus delights end users and security teams by replacing passwords across the enterprise with the simplicity and security of strong passwordless authentication. The company solution breaks the long-standing security paradigm, proving that organizations can have better security with a better user experience while reducing costs. (Secret Double Octopus 24.10)

10: ISRAEL ECONOMIC STATISTICS

10.1 Israel’s CPI Fell by 0.2% in September

Israel’s Consumer Price Index (CPI) fell 0.2% in September, the Central Bureau of Statistics announced on 15 October. This was also in line with the prediction of the pundits. Over the past twelve months to the end of September, the index rose 0.3%, well below the government’s 1% – 3% annual inflation target range. Prices have risen by 0.6% since the beginning of 2019.

Fresh fruit and vegetables led the price rises last month, up 4.3% while culture and education prices fell 2.8%, transport prices fell 1.1% and food prices fell 0.6%. The housing price index resumed its rise. Home prices in the July-August period rose 0.1% in comparison with June-July. Home prices have risen 1.3% over the past year. (CBS 15.10)

10.2 More Homes Being Built In Tel Aviv Than Any Other City in Israel

An investigation by Globes found that 13,000 housing units were built in Tel Aviv from July 2015 to June 2019, an average of 3,300 homes a year, making it the leader in Israeli construction by a wide margin. This is based on figures from the Central Bureau of Statistics. Tel Aviv leads Jerusalem, with 10,364 housing units. These were the only two cities where over 10,000 housing units were built during this period.

Construction in Tel Aviv was dominated by urban renewal projects in the eastern part of the city (neighborhood 9) and in the area of the new Central Bus Station (neighborhood 8), as well as new projects in Jaffa and the neighborhoods next to the Yarkon River. Housing starts in July 2018-June 2019 averaged 4,700, the most in at least the past 15 years. In third place after Tel Aviv and Jerusalem was Harish with 6,759 homes during the four-year period, caused by strong government backing and the allocation of discount homes for young people. Petah Tikva and Netanya, on the other hand, which experienced massive construction for many years, were relegated to 10th and 12th place, respectively in July 2015-June 2019.

One major cause of the shift in focus among contractors was the government’s Buyer Fixed Price Plan. Five of the 10 leading cities in construction were in the focus of this plan: Harish, Ashkelon, Rosh HaAyin, Beer Sheva and Rishon LeZion. The state has already been promoting construction in Ashkelon for over 10 years and in Rosh HaAyin for seven years: housing starts in the past four years have exceeded 6,000 in both of these cities, consisting mostly of discount housing for young couples.

Beer Sheva is another city of boom and bust in construction, depending on government policy. A thousand of housing units were added to the city early in the previous decade in the Neve Zeev and Ramot neighborhoods, leaving local developers with a serious problem of large excess supply. Land was again marketed for thousands of homes in recent years in the western and northern outskirts of the city, bringing the number of building starts to 5,500 in recent years. As in the past, marketing consisted of cheap housing and was aimed at young couples. (Globes 15.10)

10.3 Israel Leads WEF Report in Entrepreneurship and Macroeconomic Stability

Israel stood firm in 20th place out of 141 economies in the World Economic Forum’s 2019-2020 Global Competitiveness Report published in October, retaining its spot from last year and once again securing the top rank for entrepreneurship and the embrace of disruptive ideas. Israel also ranked first for categories such as macroeconomic stability – minimizing its national economy’s vulnerability to the impact of any external shocks – companies’ innovative growth, R&D expenditures, and multi-stakeholder collaboration.

While Israel’s overall performance remains virtually unchanged from last year, the country has dropped four places from 16th place in the 2017-2018 report. It ranked 24th overall in 2016-2017. According to the WEF’s report, Israel is an innovation hub, ranking 15th on the Innovation capability pillar thanks to a well-developed ecosystem, and up from last year’s 16th place. Israel spends the most of any country on R&D (4.3% of GDP) and is where entrepreneurial culture is the strongest, the acceptance for entrepreneurial failure the highest, where companies embrace change the most, and where innovative companies grow the fastest.

In the WEF report, Israel ranked fourth for business dynamism, its second-highest-ranking under a category, which looks at entrepreneurial culture and the administrative requirements of running a business. Israel also received top marks for “attitudes toward entrepreneurial risk” and “growth of innovative companies,” which are all subcategories are business dynamism, and ranked first in the “companies embracing disruptive ideas” subcategory, up from the third spot last year. In its biggest improvement from last year, Israel placed first in the “credit gap” indicator in the stability pillar under the financial system category. Last year, Israel was 86th in the same subcategory.

Israel ranked second in the venture capital availability subcategory and “ease of finding skilled employees” as it did last year, coming in only behind the United States in that sub-pillar. Both factors support a flourishing and innovative private sector, the WEF report stated. The country can “rely on a highly-educated workforce, with an average of 13 years of schooling” (12th in ranking globally, down from nine last year), and a propensity for a population with digital skills (sixth spot). However, the market efficiency sub-category, where Israel ranked 32nd, suffers from a relative lack of competition and barriers to entry. Israel led the Middle East and North Africa region, with the highest overall score, followed by the United Arab Emirates (25th), Qatar (29th) and Saudi Arabia (36th). (NC 21.10)

11: IN DEPTH

11.1 ISRAEL: Summary of Israeli High-Tech Company Capital Raising in 2019’s Third Quarter

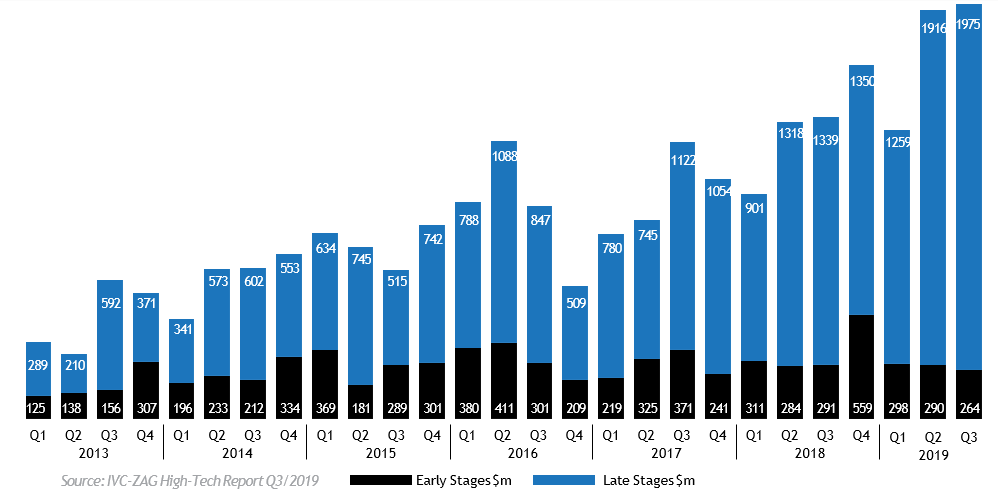

The IVC Research Center and ZAG-S&W announced on 29 October that Israeli high-tech companies raised $2.24 billion in the third quarter of 2019, the highest quarterly amount since 2013. While the amount raised in Q3 kept pace with amounts raised in Q2/2019, deal numbers increased compared to the previous quarter (128 deals) and Q3/2018 (119 deals).

Chart 1: Israeli High-Tech Capital Raising Q1/2013–Q3/2019

Like previous quarters, in Q3/2019, IVC Research Center noted a high number of large deals, each over $50 million. These 13 large deals attracted 57% of the total capital raised this quarter.

The six largest Q3/19 deals totaled $841 million (over $100m each):

According to IVC’s findings, in Q3/2019, VC-backed deals raised $1.6 billion in 81 deals compared to $1.31 in 72 deals in Q3/2018. During the first three quarters of the year, VC-backed deals raised $4.68 billion, almost the same amount raised for all of 2018.

Revenue growth companies led capital raising in Q1–Q3/2019, with $2.58 billion in 48 deals, an increase of 65% in capital and 23% in number of deals from the annual figures of 2018, which was more favorable for companies at initial revenues stages.

Adv. Shmulik Zysman, Managing Partner & high-tech industry leader at Zysman, Aharoni, Gayer & Co. (ZAG-S&W), said: “As a former athlete, I know that once you reach first place, the real difficulty is holding on to it. After seeing record-breaking numbers in the previous quarter, the third quarter even surpassed it, with this year’s recruitment record breaking compared to every previous quarter. The record was recorded both for the Israeli funds whose total borrowing remains high and stable, and for the total capital, which climbed by 45% in the corresponding quarter last year and last quarter.”

According to Zysman: “The data suggests that changing investor preferences may constitute a warning sign previously pointed out by us – ‘less risky venture capital.’ The proportion of total capital invested in early-stage companies relative to the total capital invested has been declining over the past year, with the lowest rate recorded this quarter. In contrast to the first three quarters of 2018, the total capital raising of early-stage companies in the first three quarters of 2019 has been relatively stable. Therefore, we have hope that this is not an unequivocal trend but only a warning sign.”

Capital Raising by Stage

The number of deals in early stage maturity level (Seed and R&D) grew 30% compared to Q3/2018. The amount raised by revenue growth companies in Q1–Q3/2019 reached $3.26 billion in 63 deals. This was due mostly to the increase in the number of deals over $50 million in this stage—23 deals in the current period.

Chart 2 – Israeli High-Tech Capital Raising by Stage Q1/2013–Q3/2019

Capital Raising by Sector

As in previous quarters, the software sector continued to lead with almost $1.4 billion raised in 52 deals. This was due to 10 deals over $50 million each, which captured 73% of the total raised by software companies. Life sciences also attracted more capital in Q3, raising $350 million in 38 deals compared to $239 million in 29 deals in Q3/2018. Capital raising by Cleantech companies also grew in number of deals (10) and amount ($85 million).

Marianna Shapira, Research Director at IVC Research Center: “The increase in capital raising activity in Israel recorded during the first three quarters of 2019 is in line with the global trend in the high-tech industry. One notable trend expected to continue during the fourth quarter of this year is the rapid growth of fast-growing software companies, especially in the artificial intelligence and cyber verticals. According to IVC’s data, over the last five years there has been a continuous increase in capital raising and exits in these technology verticals, and more than 70% of active companies are in sales stages. Moreover, even though there has been no increase in the capital raising in the early stages, IVC expects the rate of funding for these companies might increase in the last quarter of this year, in accord with the trend observed in previous years.”

Israeli Venture Capital Funds

In Q3/2019, Israeli VC funds invested a total of $280 million in 56 deals (out of $1.02 billion raised in total by those deals). Most of the capital (49%), was invested in companies in the initial revenue stage.

Israeli VCs have accelerated their involvement in local companies in Q1–Q3/2019, with 267 investments, a growth of 18% compared to 226 investments in Q1–Q3/2018.

Methodology

This survey reviewed capital raised by Israeli high-tech companies from Israeli and foreign venture capital funds as well as other sources, such as investment companies, corporate investors, incubators, and angels. The survey is based on reports from 482 investors, of which 58 were Israeli VC funds and 424 were other entities. The term “early stage” refers to high-tech companies in the Seed and R&D stages, not yet offering products to the market.

About the authors of this report:

IVC Research Center is the leading online provider of data and analysis on Israel’s high-tech & venture capital industries. Its information is used by key decision-makers, strategic and financial investors, government agencies, and academic and research institutions in Israel. IVC-Online Database (www.ivc-online.com) showcases over 8,600 Israeli technology startups, and includes information on private companies, investors, venture capital and private equity funds, angel groups, incubators, accelerators, investment firms, professional service providers, investments, financings, exits, acquisitions, founders, key executives, and Multinational Corporations.

ZAG-S&W (Zysman, Aharoni, Gayer & Co.) is an international law firm with offices in Israel, the US, China and the UK. The firm’s attorneys specialize in all disciplines of commercial law for both publicly held and private companies, with particular expertise in hi-tech, life science, international transactions and capital markets. ZAG-S&W provides result-driven legal and business advice to its clients, addressing all aspects of the clients’ business activities, including penetration into new markets in strategic locations. (ZAG-S&W 29.10)

11.2 LEBANON: IMF Executive Board Concludes 2019 Article IV Consultation with Lebanon

On 11 September 2019, the Executive Board of the International Monetary Fund (IMF) concluded its 2019 Article IV consultation with Lebanon.

Lebanon’s economic growth slowed to around 0.3% in 2018 on the back of low confidence, high uncertainty, tight monetary policy and a substantial contraction in the real estate sector. Most high-frequency indicators point towards a continuation of weak growth in 2019. Inflation spiked to 6% in 2018, up from 4.5% in 2017, partly due to high prices of imported fuel but slowed down in the second half of the year and into 2019.

The headline fiscal deficit increased significantly, reaching 11% of GDP in 2018, up from 8.6% of GDP in 2017, partly due to an increase in the public sector salary scale and new hiring despite the hiring freeze. The budget approved by Parliament in July 2019 targets a deficit of 7.6% of GDP based on various revenue and expenditure measures. Staff estimates that the deficit will likely be higher due to optimistic assumptions in the budget about growth and the impact of revenue measures. Public debt is projected to increase to 155% of GDP by the end of 2019.

Deposit inflows, which finance Lebanon’s twin deficits, slowed down in 2018. The BdL has continued its financial operations to facilitate banks offering high returns on USD deposits, with the aim of attracting USD deposits to the banking sector and maintaining a high level of foreign reserves.

During 2018–19, the authorities have also taken some important structural measures. Parliament has approved a plan to reform the electricity sector in April 2019, which is expected to contribute to a reduction of the fiscal deficit over the medium term. Other laws approved include a code of commerce and a law on judicial intermediation. These and other planned reforms could encourage donor disbursements of concessional financing for the Capital Investment Plan (CIP) committed at CEDRE in April 2018.

Executive Board Assessment

Executive Directors agreed with the thrust of the staff appraisal. They acknowledged that Lebanon has shown unique resilience in the face of long-standing economic challenges, but noted that strong and steadfast efforts are critically needed to ensure macroeconomic stability against a difficult economic situation with high debt, twin deficits and a weak external position. Directors noted that the ongoing Syrian conflict has exacerbated Lebanon’s challenges. In this regard, they commended the authorities for their generous support in hosting the refugees and agreed that Lebanon needs continued international support.

Directors emphasized the need for a multi-year fiscal adjustment to reduce public debt to sustainable levels. While the approval of the 2019 budget by parliament is an important first step, Directors noted that achieving the authorities’ primary surplus goals and rebalancing the economy will require credible measures–both on the revenue and expenditure sides—and sustained implementation. They viewed that fiscal measures should include raising the VAT rate, broadening the tax base and removing exemptions, as well as increasing fuel excises and eliminating electricity subsidies. Directors noted that these measures should be complemented by a thorough expenditure review to achieve sustained fiscal savings. They noted that a successful implementation of the government’s Capital Investment Plan, financed on concessional terms, could help mitigate the contractionary effect of the adjustment on growth. To protect the most vulnerable people, Directors underscored the need for a stronger social safety net.

Directors commended the Banque du Liban (BdL) for maintaining financial stability while emphasizing the need to rebuild its financial strength. They encouraged the BdL to step back from quasi-fiscal operations, strengthen its balance sheet and require banks to build up their own buffers further. Directors highlighted the importance of implementing AML/CFT measures efficiently to continue to mitigate risks and ensure a positive MENA Financial Action Task Force assessment.

Directors noted that the fiscal adjustment effort needs to be complemented by fundamental structural reforms to raise growth and improve Lebanon’s fiscal and external position. While the approval of the new electricity sector plan and legislative process on the government’s CEDRE vision reforms are important first steps, they saw the need for decisive actions to remove growth bottlenecks and enable external adjustment in the context of the currency peg. Directors also called on the authorities to address governance weaknesses that increase Lebanon’s vulnerability to corruption. (IMF 17.10)

11.3 LEBANON: The Mass Demonstrations in Lebanon – What Do They Portend?

Orna Mizrahi posted in INSS Insight No. 1218 on 25 October that the demonstrations throughout Lebanon recently erupted spontaneously and saw a full range of the population participating and calling on the leaders of all communities to form a new government and change the current order. The immediate trigger for the protest was a decision to impose a tax on WhatsApp calls; at the heart of the demonstrations, however, is the worsening economic situation and paralysis of a “unity government” hard-put to progress toward solutions that can improve the situation. The mass protest reflects the despair and exasperation with a corrupt leadership. On the other hand, there are signs that all components of the leadership, including Hezbollah, are not interested in changing the current system, and therefore supported a “recovery plan” that was hastily drafted by the cabinet. The plan entails placing the tax burden on the stronger socio-economic levels, but implementation is expected to be difficult. Clearly the public, which continues with the protests, has little faith in the plan. It is difficult to assess whether the protest will ebb soon or lead to the cabinet’s resignation or even to anarchy. It seems that Lebanon’s salvation can only be achieved with generous foreign aid, preferably from the West and from Gulf states so as to prevent Hezbollah and its patron, Iran, from assuming complete control over the country.

A popular protest erupted in Lebanon on 17 October 2019 on a scale unprecedented in recent years. Mass demonstrations grew steadily stronger in successive days, and have so far numbered between tens of thousands and hundreds of thousands of participants as they spread from Beirut to the country’s other principal cities. For now, the protests continue. The trigger for the demonstrations – in the sense of “the straw that broke the camel’s back” – was an unusual decision (rescinded immediately, one day after the protest erupted) to tax WhatsApp voice calls. This tax was meant to serve as one component in a network of new taxes in the framework of a 2020 budget that the cabinet is trying to advance, as it strives to meet international demands for reform so Lebanon will be eligible to receive $11 billion in loans for investment in national projects that were pledged at an April 2018 conference in Paris and have yet to be delivered.

The current protest is highly distinctive in its emergence as a spontaneous outpouring bereft of sectarian flavor that has drawn in citizens from all parts of society, and from all faiths and sectors, in a shared call for the resignation of the cabinet and a change of the current order. Significantly, the demonstrators have directed their calls at all facets of the leadership: the Christian President, Michel Aoun; the Shiite speaker of parliament, Nabih Berri; and the Muslim Prime Minister, Saad al-Hariri. There have also been calls directed against Hezbollah.

This mass protest reflects the despair among the Lebanese public at a difficult economic situation and low living standards; exasperation with a corrupt leadership comprising old elites from all confessional groups that look out only for their own interests; and a dearth of trust in the current government’s ability to devise solutions to improve the situation. Protest events have not been free of violence, both by demonstrators (with the burning of tires and disruption of routine life) and by security forces (with the use of tear gas and arrest of demonstrators), yet as the scale of participation has broadened, so have the streets been flooded with Lebanese flag-waving crowds. The protest has become a national celebration evincing hope for better lives. The essence of the protest was captured by a sign waved by one participant, “I fight to live.”

Core Reasons for the Protest

Over the past decade, Lebanon’s citizens have suffered deteriorating living standards given a worsening economic situation. Lebanon is in a deep economic crisis: its foreign debt is approximately $85 billion, and it is on the verge of bankruptcy (Fitch recently downgraded Lebanon’s credit rating to CCC); Lebanese unemployment is high (young people make up some 36% of the unemployed); national infrastructures are run down, and there are serious electricity and water shortages; and national institutions, including the justice system and security apparatus, are tainted by chronic corruption. Lebanon has also suffered consequences from the civil war in Syria, mainly the burden of hosting some 1.5 million Syrian refugees, which together with the established Palestinians make up around a quarter of the population.