![FortnightlyReport]()

4 September 2019

4 Elul 5779

5 Muharram 1440

TOP STORIES

TABLE OF CONTENTS:

1: ISRAEL GOVERNMENT ACTIONS & STATEMENTS

1.1 Israel & South Korea Finalize Free Trade Agreement in Jerusalem

1.2 Israel & US Sign MOU to Strengthen Cooperation Between MASHAV and USAID

1.3 Honduras Trade Delegation to Visit Israel & Mark Recognition of Jerusalem as Israel’s Capital

1.4 Prime Minister of Ethiopia Visits Israel

2: ISRAEL MARKET & BUSINESS NEWS

2.1 Rookout Raises $8 Million in Series A Funding to Set New Standard in Software Observability

2.2 Salesforce Signs Definitive Agreement to Acquire ClickSoftware

2.3 BIRD Partners Take Renewable Energy Microgrids Into the AI & Machine Learning Age

2.4 Tricentis Acquisition Extends Selenium and Appium Test Automation in the Cloud

2.5 Rail is Going Global in India With the Partnership of ConfirmTKT and Save A Train

2.6 WSC Sports Raises $23 Million in Series C Funding

2.7 American Airlines to Launch Tel Aviv – Dallas Flights

2.8 TriEye Raises $2 Million More for Cameras That Can See in the Dark

2.9 Sino-Israel Center to Launch at Bar-Ilan University Nanotech Institute

2.10 Revuze Attracts Investment from the SAP.iO Fund

2.11 BlackBerry to Close Israel Development Center

2.12 El Al to Launch Routes to Dublin and Dusseldorf

2.13 McDonald’s Israel Expands Vegan Burgers to 40 Branches

2.14 Axonius Raises $20 Million More to Support Rapid Market Success

2.15 Music Education Startup JoyTunes Raises $25 Million

2.16 Intel Lays Cornerstone for Mobileye’s New Global Development Center in Jerusalem

2.17 Israel’s F2 Capital is Raising $75 Million to Invest in Homegrown Startups

2.18 Yissum Wins Bid to Host Largest International Technology Transfer Conference in 2019

3: REGIONAL PRIVATE SECTOR NEWS

3.1 The Rise of Venture Capital Funding in Jordan

3.2 SINC Raises $250,000 in a Pre-Seed Funding Round

3.3 The Importance of Fashion to the UAE’s Retail Market

3.4 Five UAE Fintech Start-Ups Graduate from Emirates NBD’s Program

3.5 UAE’s Group 42 Invests $65 Million in Chinese eCommerce Platform Jollychic

3.6 Saudi Arabia’s Nana Direct Raises $6.6 Million for Expansion

3.7 NowPay Closes $600,000 Seed Round from Silicon Valley’s Endure Capital & 500 Startups

3.8 Egypt & Bombardier Agree to Build Two Monorails

3.9 Chefaa Closes Significant Seed Funding Round

3.10 Egypt’s Harmonica Acquired by Dallas’ Match Group

3.11 Trella Joins Y Combinator’s S19 Batch

3.12 Egypt’s Wholesale and Retail Food Market in 2019

3.13 ADTRAN to Invest in Egypt to Create a Better Broadband Experience

4: CLEAN TECH & ENVIRONMENTAL DEVELOPMENTS

4.1 Vertical Field Launches Study on the Impacts of “Smart Living Walls”

4.2 Israel’s Ashalim Solar Thermal Power Station Begins Operations

4.3 Israel to Invest NIS 30 Million in New Plastic Recycling Technologies

4.4 Jordan Sees Clean Energy to Cover 20% of its Power Needs by 2022

4.5 Bahrain Bans Sand Dredging in Order to Repair Seabed

4.6 Oman’s Dhofar Wind Farm Produces First Kilowatt Hour of Electricity

5: ARAB STATE DEVELOPMENTS

5.1 Lebanon’s Annual Average Inflation Rate Stands at 3% in July 2019

5.2 Lebanon’s Trade Deficit Ended at $8.04 Billion in First Half of 2019

5.3 Jordan’s Average Inflation Rate for July 2019 Rises by 0.2%

5.4 Jordanian Unemployment Continues to Rise Unabated

5.5 Chinese Company Signs $1.4 Billion Iraq Construction Deal

![♦]()

![♦]() Arabian Gulf

Arabian Gulf

5.6 Bahrain Says Budget Deficit Narrows to $1 Billion in First Half of 2019

5.7 Trademark Infringements in Dubai Increase By 23% in First Half

5.8 UAE’s Third Nuclear Plant Hits Key Power Testing Milestone

5.9 UAE to Add Sugary Drinks and E-Cigarettes to Excise Tax List in 2020

5.10 Saudi Arabia Replaces Royal Court Chief and Creates Ministry of Industry

5.11 Saudi Arabia Launches $826 Million in Water Projects

![♦]()

![♦]() North Africa

North Africa

5.12 Egypt’s Annual Inflation Rate Declines to 7.8% in July

5.13 Remittances from Egyptians Abroad Rose to Around $3 Billion in May

5.14 Morocco’s Consumer Price Index Down 0.8% in July

5.15 Morocco Hosts 5.4 Million Tourists During First Half of 2019

5.16 Morocco Faces High Water Stress and Ranks 22nd Worldwide for Stressed Nations

6: TURKISH, CYPRIOT & GREEK DEVELOPMENTS

6.1 Erdogan Says Turkey Wants to Continue Defense Cooperation with Russia

6.2 Turkey Foreign Trade Deficit Narrows 47% in July

6.3 Turkish Central Bank Says End of Tax Cuts Boosted Inflation

6.4 Turkey Draws Nearly 25 Million Foreign Visitors in 7 Months

6.5 Over 88% of Turkish Households Have Internet Access

6.6 Turkish E-Commerce Growth Stymied by Logistics Problems

6.7 Greece Posts January – July Surplus of €1.76 Billion

6.8 Greek Exports & Imports Decline Steeply In June

6.9 Cyprus-Greece-Israel-US Cement Eastern Mediterranean Security Partnership

6.10 Greeks Expanding Use of Credit Cards

6.11 Greek Housing Sector Rebounds at Strongest Rate in More Than 12 Years

7: GENERAL NEWS AND INTEREST

![♦]()

![♦]() Israel

Israel

7.1 Immigration to Israel Increases by Nearly 30%, Largely Due to Russian Speakers

![♦]()

![♦]() Regional

Regional

7.2 Saudi Arabia’s Six Flags Qiddiya to Feature World’s Fastest Roller Coaster

7.3 Turkey Bans Istanbul’s ‘Queer Olympix’

8: ISRAEL LIFE SCIENCE NEWS

8.1 Can-Fite to Treat Advanced Liver Cancer Patients with Namodenoson in Israel

8.2 CartiHeal Performs First Agili-C Cartilage Repair Implantation Procedures at New York Hospital

8.3 Corteva Agriscience Invests in Evogene’s Agriculture Biologicals Subsidiary, Lavie Bio

8.4 Nobio Receives FDA Clearances for Infinix Flowable & Bulk Fill Composites

8.5 GemmaCert Raises $3.5 Million

8.6 Teva Announces Availability of a Generic Equivalent of EpiPen Jr in the United States

8.7 MDClone, Developer of First Healthcare Synthetic Data Engine, Raises $26 Million

8.8 Terason Partners With DiA Imaging Analysis for Superior AI Cardiac Solutions

8.9 Carevature’s Cutting-Edge Dreal Technology Now Available to Spine Surgeons at Scripps Health

8.10 Check-Cap & GE Healthcare Complete Manufacturing Line Transfer for C-Scan System

8.11 V-Wave’s Interatrial Shunt Receives FDA Breakthrough Device Designation for Heart Failure

8.12 FDA Clears Biobeat for Non-invasive Cuffless Monitoring of Blood Pressure

8.13 Genetic Screen Identifies Genes That Protect Cells from Zika Virus

8.14 ApiFix Receives FDA Approval to Commercialize its MID-C System

8.15 DiA Imaging Analysis & Edan Instruments Accelerate Adoption of DiA’s Cardiac Solutions

8.16 CartiHeal Performs First Agili-C Cartilage Repair Implantation Procedure in Texas

8.17 Cannibble Food-Tech Announces the USA Launch of Its New Cannabis Infused Edibles

8.18 Sheba, Tel HaShomer & Telesofia Medical Announce Cutting-Edge Telemedicine Software

8.19 Maverick Medical AI Announces First Commercial Deployment at USHS Health System

9: ISRAEL PRODUCT & TECHNOLOGY NEWS

9.1 Mellanox Ethernet and InfiniBand Solutions Deliver Breakthrough Performance

9.2 Checkmarx Named ‘Black Unicorn’ Award Winner for Vision in Software Security

9.3 Netline Provides C-Guard IED Jamming System for the Israel Defense Force

9.4 accessiBe Launches First-Ever AI-Driven Web Accessibility Tool

9.5 Lightbits Labs Cited as Startup of the Year in the 14th Annual 2019 IT World Awards

9.6 Vayyar Launches First Universal Sensor Solutions to Put an End to Hot Car Deaths

9.7 Eye-Net Mobile Successfully Completes Connected Car Controlled-Environment Trial

9.8 S1 Medical Goes Live With Sapiens’ Workers’ Compensation Solution

9.9 D-ID Adds New Anonymization Solution for Video and Still Images

9.10 Israel Selects Elbit Systems’ Iron Fist Light Decoupled Active Protection System

9.11 ECI and KPGCo Selected by CL Tel to Modernize Its Network Infrastructure in Iowa

9.12 Convizit Wins Pitango’s $1 Million Startup Competition

10: ISRAEL ECONOMIC STATISTICS

10.1 Israel’s Composite State of the Economy Index for July 2019 Increases by 0.2%

10.2 Unemployment Down Sharply in Israel

10.3 Israel’s Budget Deficit Remains at Highest Level Since 2014

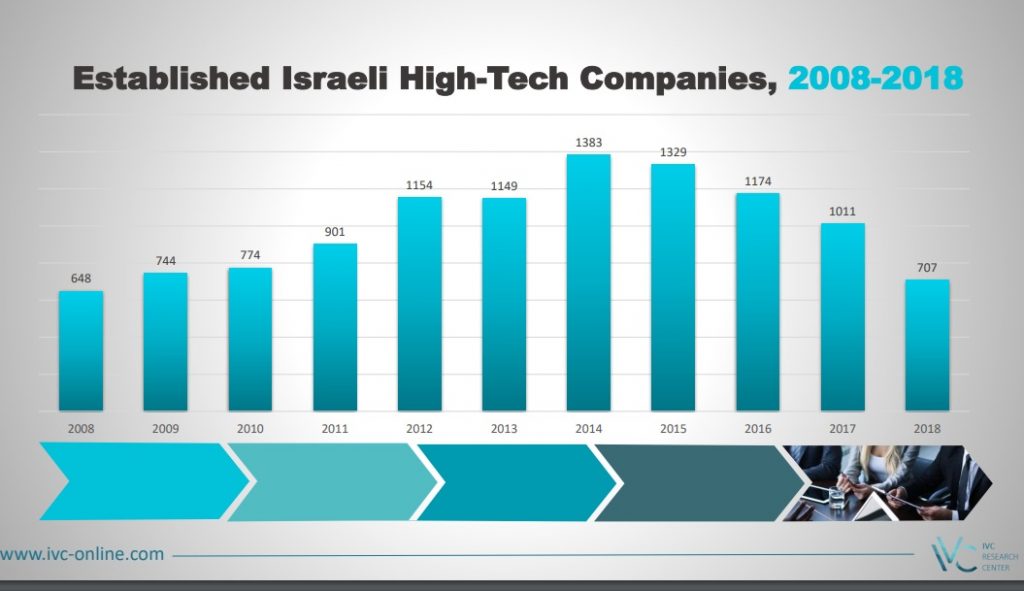

10.4 Hi-Tech Sector Employment in Israel Surpasses 300,000 Workers

10.5 Israeli Startups Raised Over $350 Million in August

10.6 August Tourism to Israel Reaches New Record

11: IN DEPTH

11.1 ISRAEL: Fitch Affirms Israel at ‘A+’; Outlook Stable

11.2 LEBANON: Lebanon Ratings Affirmed At ‘B-/B’; Outlook Remains Negative

11.3 JORDAN: Cash-Strapped Jordan Imposes New Taxes; Public Anger Ensues

11.4 IRAQ: Iraq Ratings Affirmed At ‘B-/B’; Outlook Stable

11.5 GCC: VAT in Gulf Arab States – Balancing Domestic, Regional and International Interests

11.6 OMAN: Challenges to Maximizing Renewables in Oman’s Energy Mix

11.7 EGYPT: Egypt Takes Another Step Toward China

11.8 EGYPT: Egypt Declares Water Emergency as Precaution

11.9 MOROCCO: King Mohammed VI Announces Plan to Promote Social & Economic Equality

11.10 TURKEY: Environmental Problems Provoke Protests on All Fronts in Turkey

1: ISRAEL GOVERNMENT ACTIONS & STATEMENTS

1.1 Israel & South Korea Finalize Free Trade Agreement in Jerusalem

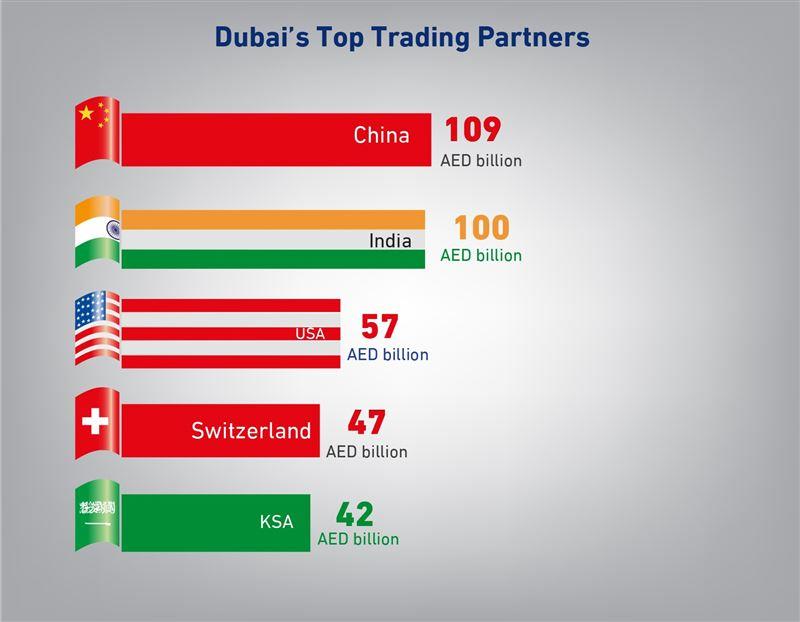

Israel and South Korea signed a Free Trade Agreement on 21 August, one which is expected to greatly reduce the cost of cars and electronics imported from Seoul. Israeli Economy Minister Eli Cohen and visiting South Korean Trade Minister Yoo Myung-hee announced the finalization of the accord at a ceremony in Jerusalem. The accord will also reduce or eliminate tariffs on Israeli exports to South Korea on goods such as wines, cosmetics, metals and industrial machinery. Afterwards, the two met with Prime Minister Benjamin Netanyahu, who hailed the deal, noting that it is Israel’s first Free Trade Agreement with an Asian economy. In 2018, trade between Israel and South Korea amounted to approximately $2.5 billion, an increase of almost 15% over 2017.

This agreement with South Korea marks a dramatic change from years past when Seoul was hesitant about cultivating close commercial ties with Israel, out of concern that it would harm their trade relations with the far bigger market with Arab and Muslim countries. One diplomatic official said that this attitude began to change when Israeli trade ties began flourishing over the last decade with China and Japan, and when it became an open secret that Arabian Gulf countries were cooperating with Israel on a variety of levels. (Various 21.08)

Back to Table of Contents

1.2 Israel & US Sign MOU to Strengthen Cooperation Between MASHAV and USAID

On 22 August, Israeli Minister of Foreign Affairs Katz and United States Agency for International Development (USAID) Administrator Green signed a Memorandum of Understanding (MOU) between USAID and Israel’s Agency for International Development Cooperation (MASHAV) in Jerusalem. The agreement seeks to strengthen cooperation between the two countries and leverage expertise on a variety of global development efforts. The MOU is a groundbreaking step that will elevate Israel’s standing in the world and broaden Israel-US partnership on mutual development priorities in third-party countries. (MFA 21.08)

Back to Table of Contents

1.3 Honduras Trade Delegation to Visit Israel & Mark Recognition of Jerusalem as Israel’s Capital

Honduran President Juan Orlando Hernández and his wife will conduct a visit to Israel next week to inaugurate a trade office, which will hold diplomatic status, in Jerusalem. Israel welcomes the opening of this trade office and sees it as an important step towards the future move of the Honduran Embassy to Jerusalem, and the opening of the Israeli Embassy in the Honduran capital. Moreover, this step reflects the close relations between our two countries, and the warm friendship between our two peoples.

President Hernández is expected to meet with Prime Minister Netanyahu at the Prime Minister’s Residence in Jerusalem. The two leaders will inaugurate the new diplomatic trade office in Jerusalem. During the course of the visit, President Hernández will visit Israel’s shipyards and is expected to participate in a high-level economic meeting with leading members of Israel’s business community. This meeting will take place with the goal of advancing investment and commercial ties between our two countries. This important visit will serve to strengthen relations between Israel and Honduras, and advance cooperation in a diverse range of fields. (MFA 21.08)

Back to Table of Contents

1.4 Prime Minister of Ethiopia Visits Israel

On 1 September, Israel welcomed the visit of the Ethiopian Prime Minister, to which it attaches great importance as it will contribute to the enhancement of the relationship and strengthen the cooperation between the two countries. Prime Minister Netanyahu received Ethiopian Prime Minister Dr. Ahmed upon his arrival with a guard of honor at the Prime Minister’s Office in Jerusalem. During the course of the visit, the Ethiopian Prime Minister met with President Reuven Rivlin, visited Yad Vashem and toured the National Cyber Directorate.

Ethiopia has a close and friendly relationship with Israel, cooperating in many fields, including agriculture, water and irrigation, health, education, science, technology and innovation. During the visit the two sides will discuss strengthening bilateral cooperation in the fields of security, agriculture and technology, with special emphasis on cyber. The Ethiopian Prime Minister’s visit to Israel is further evidence of PM Netanyahu’s ‘Return to Africa’ policy and the common desire of both countries to strengthen the bonds of friendship and deepen bilateral cooperation. (MFA 30.08)

Back to Table of Contents

2: ISRAEL MARKET & BUSINESS NEWS

2.1 Rookout Raises $8 Million in Series A Funding to Set New Standard in Software Observability

Rookout has raised $8 million in a Series A funding round that was led by Cisco Investments, who made a strategic investment alongside existing backers TLV Partners and Emerge. Additionally, industry leaders including Nat Friedman, CEO of GitHub, John Kodumal, CTO and Cofounder of LaunchDarkly, and Raymond Colletti, VP of Revenue at Codecov, added their support. Rookout will use the funding to continue its commercial growth while expanding its core offering to cover additional observability use cases and languages. Coinciding with this news, the company also announced a free tier option.

Since exiting stealth just over a year ago, Rookout’s code-level data collection has defined a new category of observability software that decouples data from code, making understanding and debugging code easier and massively faster. Companies using Rookout have seen the time it takes to make a single observation reduced from hours to a few seconds, minimizing the chore aspects of debugging, providing deep code insights and freeing up vital R&D resources to focus on features.

Tel Aviv’s Rookout allows software engineers to set “non-breaking breakpoints” with a single click, collecting live code execution data on-the-fly, without stopping the code or requiring any redeployment. Rookout’s flexibility enables it to be used in the most modern infrastructures, including containerized code on Kubernetes clusters, as well as traditional legacy systems; it’s also the first and only solution for debugging the code of live serverless functions in production. In the coming year, the company plans to add additional programming languages alongside its existing support for JVM-based languages like Java and Kotlin, as well as NodeJS and Python. (Rookout 07.08)

Back to Table of Contents

2.2 Salesforce Signs Definitive Agreement to Acquire ClickSoftware

San Francisco’s Salesforce signed a definitive agreement to acquire ClickSoftware, a leader in field service management solutions. The addition of ClickSoftware will enhance Salesforce Service Cloud’s leadership as the #1 service platform, empowering every service employee from the contact center to the field to deliver more connected, intelligent customer service.

ClickSoftware enables companies to intelligently schedule and optimize field service work. Salesforce Field Service Lightning, built on Service Cloud, harnesses the latest in dispatching, mobile workforce empowerment and IoT technologies to empower companies to connect their entire service workforce on a single, centralized platform. With the combined capabilities of Field Service Lightning and ClickSoftware, Salesforce will be positioned to lead the way to the future of field service.

Salesforce introduced Field Service Lightning in 2016 to empower the mobile workforce with a 360-degree view of the customer, predictive insights and an offline-first mobile app. ClickSoftware and Salesforce have partnered since Field Service Lightning launched to deliver proactive, intelligent field service. With ClickSoftware and Field Service Lightning, if a mobile employee gets delayed by traffic, a dispatcher can quickly route another field technician to the job so the customer’s appointment does not get delayed. These interactions are then automatically updated across the entire Salesforce platform so everyone — customers, sales, customer service and field service — has complete visibility.

Petah Tikva’s ClickSoftware is the leading provider of field service optimization solutions that help you improve the efficiency and effectiveness of your field service operations. (Salesforce 07.08)

Back to Table of Contents

2.3 BIRD Partners Take Renewable Energy Microgrids Into the AI & Machine Learning Age

Portland, Maine’s Introspective Systems has finalized its contract with the Binational Research and Development Foundation (BIRD US-Israel Foundation) to begin a commercialization project with its Israel-based partner, Brightmerge. The companies will leverage their areas of expertise to create an end to end AI-based data solution for Microgrid design, development, and operations. Brightmerge and Introspective Systems have the industry knowledge and technological know-how to provide seamless solutions that bring entire economies into the digital age of energy. Brightmerge currently has several premium, paid pilots with large clients that understand the potential of the microgrid revolution. These clients wish to move now instead of waiting and keep losing money. The project is expected to reach alpha stage of development by Q2/20 with first production versions ready at the beginning of 2021.

Introspective Systems is the developer of xGraph, a breakthrough software platform that enables developers to build systems designed for complex software ecosystems. xGraph is AI-enabled for systems that require autonomous and collaborative decision-making to meet the challenges of complexity in environments including healthcare, IoT, energy and science.

Modiin’s Brightmerge develops an online cloud-based expert system that accurately predicts a microgrid system’s energy and financial performance. The platform integrates data sets in one platform and automates decision making using ranking and optimization algorithms to choose the best components, suppliers, and contractors for each project. The company opened a fund round to complete the product and drive first sales. (Introspective Systems 08.08)

Back to Table of Contents

2.4 Tricentis Acquisition Extends Selenium and Appium Test Automation in the Cloud

Mountain View, California’s Tricentis has acquired TestProject, a first-of-its-kind community-powered test automation platform designed for Agile teams. As part of its commitment to TestProject, Tricentis will be investing in research and development to advance the product, extend the community, and help testers master best practices for web, Android and iOS test automation.

TestProject is built on the leading open source test automation tools: Selenium and Appium. It supports all major operating systems, and enables any software team to test web, Android and iOS apps using a “low-code/no-code” approach. With the community-driven approach, automation building blocks are shared with the entire community – reducing the time required to construct robust test automation. AI-based matching automatically analyzes the application under test and recommends add-ons that will enhance the tests.

Founded in 2015, Petah Tikva’s TestProject is the world’s first cloud-based, community testing platform. TestProject makes it easier for testers to do their jobs quickly, and to collaborate using popular open source frameworks (e.g., Selenium and Appium) to ensure quality with speed. By fostering a collaborative community that can come together — as individuals and in teams — TestProject is shaping the future of software testing. (Tricentis 08.08)

Back to Table of Contents

2.5 Rail is Going Global in India With the Partnership of ConfirmTKT and Save A Train

ConfirmTKT, the largest independent train tickets seller in India, just launched European train ticketing solution in collaboration with Save A Train. ConfirmTKT is probably the largest OTA to date that is trying to grab this major market, and this launch is only the beginning as Save A Train offerings is planned to extend later this year to North America / China / Russia and more. Through this partnership, ConfirmTKT aims to expand and strengthen its foothold in the lucrative European market.

Ramat HaSharon’s Save a Train is an innovative Railtech startup developing and implementing a series of rail tech travel products & solutions that enable competitive online trains tickets booking, dynamic pricing for train tickets and advanced revenue systems and BI for railway operators. (Save A Train 08.08)

Back to Table of Contents

2.6 WSC Sports Raises $23 Million in Series C Funding

WSC Sports has raised $23 million in Series C funding, bringing the company’s total funding to $39 million. The new capital will be used to further expand WSC’s growth across new sports, products and geographic regions. This funding round was led by O.G. Tech Ventures – the international tech investment arm of Ofer Global, along with NTT DOCOMO Ventures, HBSE Ventures – the venture arm of Harris Blitzer Sports & Entertainment, Maor Investments, ISF and Go4it Capital.

WSC Sports’ award-winning AI technology generates personalized and automatic sports video content in near real-time. WSC has innovated the way sports and media owners create and distribute short-form video highlights at scale and works with tier-1 clients including NBA, Bundesliga, PGA Tour, US Open, Bleacher Report, Discovery, MLS, FIBA, Cricket Australia, WarnerMedia and many more. In 2018, WSC Sports analyzed more than 17,000 sporting events and produced more than 850,000 videos for its customers.

Existing investors also joined the funding round, including Intel Capital, Detroit Venture Partners (Dan Gilbert’s venture capital firm), Elysian Park Ventures, WISE Ventures (Wilf family, owners of the Minnesota Vikings), 2BAngels and iAngels. The funding comes after a year of explosive growth for WSC Sports – doubling its customer base and revenue year over year for the last 3 years, growing to more than 100 employees worldwide and expanding its global footprint with offices in New York and Sydney.

Givatayim’s WSC Sports‘ platform generates personalized sports videos for every platform and every sports fan – automatically and in real-time. Currently being used by leading media rights owners such as WarnerMedia, NBA, MLS, US Open, PGA Tour, Bundesliga and others, WSC Sports’ platform utilizes advanced AI capabilities to analyze live sports broadcasts, identify each and every event that occurs in the game, create customized short-form video content, and publish to any digital destination. This enables partners to instantly generate and distribute professionally edited personalized clips and videos on a large scale to engage audiences and maximize video monetization opportunities. (WSC Sports 08.08)

Back to Table of Contents

2.7 American Airlines to Launch Tel Aviv – Dallas Flights

American Airlines announced that it will be launching a new Tel Aviv – Dallas-Fort Worth (DFW) route. The service will include three weekly flights, beginning on 9 September 2020. American Airlines will use Boeing 787-9s for these flights. American Airlines flew to Israel until 2015 when it halted its Tel Aviv – Philadelphia route. The carrier claimed the cancellation was for financial reasons following a drop in tourism to Israel. DFW is the airlines biggest hub and it will offer passengers connection services to 33 US cities. (AA08.08)

Back to Table of Contents

2.8 TriEye Raises $2 Million More for Cameras That Can See in the Dark

TriEye expanded its series A round from $17 million to $19 million with an investment from Porsche. The newfound funds, which bring the startup’s total raised to date to $22 million, will accelerate ongoing product development, operations, and hiring. TriEye also provides software and AI-powered remote sensing platforms it says are based on well over a decade of nano-photonics research, and that were developed by a team of experts in device physics, process design, electro-optics and deep learning. The company asserts the full-stack approach positions it well to tackle verticals beyond automotive, like mobile, industrial, security, and optical inspection.

TriEye’s backers include Intel Capital, cybersecurity entrepreneur Marius Nacht, and Grove Ventures. It competes to an extent with sensor suppliers such as Oregon-based Flir, which manufactures thermal vision cameras embedded with machine learning algorithms, and Boston-based startup WaveSense, which is developing ground-penetrating radars (GPR) for autonomous cars.

Tel Aviv’s TriEye’s Raven is an HD shortwave infrared (SWIR) camera solving the low-visibility challenge for ADAS and AV. TriEye’s life-saving technology is based on a decade of nanophotonics research, enabling affordable mass production of SWIR sensing on a CMOS-based sensor. SWIR enables vision under adverse weather and night-time conditions, mounting behind the windshield and seamless integration with existing vision AI algorithms (i.e. Object Recognition). TriEye’s CMOS-based design enables HD resolution, low power consumption, small form factor and 1,000x lower cost compared to current technologies. (TriEye 21.08)

Back to Table of Contents

2.9 Sino-Israel Center to Launch at Bar-Ilan University Nanotech Institute

Israel’s Bar-Ilan University Institute of Nanotechnology and Advanced Materials (BINA) and the Chinese Academy of Sciences (CAS) signed a joint agreement in Beijing on 20 August to establish a Chinese Center of Excellence within Israel’s Bar-Ilan University. The Chinese National Academy of Sciences will set up the center, which will include a research lab focused on nanomedicine, 2D materials engineering, and graphene production. The center will host scientists from additional research institutes in Israel. The signing ceremony took place at the Chinese National Nanotechnology and Nanoscience Institute (NCNST) in the presence of diplomats from the Israeli Embassy in Beijing.

The main goal of the joint research laboratory, according to the agreement, will be to integrate teamwork between Chinese and Israeli researchers and industrialists from both countries. This will facilitate the transfer of theoretical research, specializing in nano-medical materials and graphene into products, readily available to consumers. (NoCamels 21.08)

Back to Table of Contents

2.10 Revuze Attracts Investment from the SAP.iO Fund

Revuze announced that the SAP.iO Fund made an investment in the company, as part of a funding round that included existing and new investors. The SAP.iO Fund joins other well-known investors in Revuze, including Nielsen, NPD, TIC Group and Prytek. The funding comes on the heels of fast international adoption of the Revuze solution across multiple industries and geographies, from China to US and Europe.

Revuze’s artificial intelligence solution is the first in the market to transform how brands consume customer experience (CX) insights. While other solutions are typically requiring experts and manual labor to deliver insights, while being limited to specific feedback channels like Social Media or Surveys, Revuze allows any role in the organization to gain deep insights from any data sources and without any manual labor or experts involved. With Revuze organizations distribute decision making, making better decisions, faster across the board. Revuze recently announced that Dolby, the leader in audio and video technologies, is leveraging Revuze to understand Mobile consumer preferences when consuming audio and video.

Backed by investors such as the SAP.iO Fund, Nielsen and NPD, TIC Group and Prytek, Netanya’s Revuze transforms how brands consume CX insights so they can make better decisions, faster across every role in the organization. While other solutions rely heavily on experts and manual labor, the Revuze solution is up and running without professional resources. (Revuze 20.08)

Back to Table of Contents

2.11 BlackBerry to Close Israel Development Center

Globes reported that Waterloo, Ontario’s BlackBerry is closing down its Israel development center with 40 employees in Petah Tikva. BlackBerry founded its development activity in Israel in 2015 on the basis of WatchDox, a startup that it acquired for $100 million. A staff of 20 employees in North America who have worked on WatchDox’s product simultaneously with employees in Israel will continue to maintain the product.

WatchDox was sold to BlackBerry after the Canadian company lost its momentum in a mobile telephony market now dominated by Google Android and Apple. The steep decline in its revenue caused BlackBerry to shed a third of its staff worldwide in 2012. Since BlackBerry’s mobile operating systems were always known for their high level of security, the company decided to switch its focus from sales of telephones to security products and services. BlackBerry completely closed down its telephone business in 2016 and laid off 200 employees worldwide. Since that time, part of BlackBerry’s business has prospered, while other parts have stagnated and been closed down. (Globes 25.08)

Back to Table of Contents

2.12 El Al to Launch Routes to Dublin and Dusseldorf

El Al Israel Airlines announced that it is launching two new routes, from Tel Aviv to Dublin and to Dusseldorf. The Israeli carrier will offer three weekly flights each to the Irish capital and German city starting in the late spring of 2020. The Tel Aviv – Dublin flights will begin from May 26 2020 on Sundays, Tuesdays and Thursdays on Boeing 737s. The Dusseldorf flights begin June 1 on Mondays, Wednesdays and Fridays. Tickets for the new routes went on sale on 4 September.

In the last quarter, El Al commenced new routes to San Francisco, Las Vegas and Manchester in addition to a new route to Nice in the first quarter. They have also announced new routes to Tokyo and Chicago, which will begin operating in March 2020. (El Al 28.08)

Back to Table of Contents

2.13 McDonald’s Israel Expands Vegan Burgers to 40 Branches

McDonald’s Israel has expanded its pilot sales of vegan burgers to 40 branches. The vegan products, called Big Vegan, is produced by Osem-Nestle subsidiary Tivoll. It was launched two months ago, and has hitherto been sold at only 18 of the chain’s 186 branches in Israel, most of them in the greater Tel Aviv area. McDonald’s is also marketing a double-size vegan burger.

In addition to physical expansion, McDonald’s Israel is also expanding its geographic deployment by opening new branches. Opening of a new branch in the Zim Urban center in Arad, a branch in the Ispro Center in Ness Ziona, a kosher branch in the Holon Mall and a branch in Afula will be completed this month. The chain will open 10 new branches by the end of the year, including the two new restaurants at Ben Gurion Airport.

The popular global trend is pushing many fast food chains to look for meat substitutes for their products. Burger King, McDonald’s competitor, has already begun marketing a vegan burger made by Impossible Foods at its branches in the US, and is gradually expanding this line. Burger King Israel, however, does not yet offer a vegan burger. Meatless hamburgers made by Beyond Meat have been sold in recent months at restaurant chains in Israel, such as Moses, BBB, and SUSU & Sons, as well as in natural food stores, where they are relatively expensive, with three hamburgers being sold for NIS 54. (Globes 27.08)

Back to Table of Contents

2.14 Axonius Raises $20 Million More to Support Rapid Market Success

Axonius has raised $20 million in Series B funding, led by new investor OpenView. Existing investors Bessemer Venture Partners, YL Ventures, Vertex, WTI and Emerge also participated in the round, bringing the company’s total funding to $37 million to date.

This funding enables Axonius to continue to accelerate demand for its Cybersecurity Asset Management Platform, the only asset management solution on the market today that leverages existing security investments to gain unmatched visibility into an organization’s asset inventory. By seamlessly connecting to over 135 security and management solutions, Axonius uncovers solution coverage gaps and automatically validates and enforces security policies. The funding will also be used to drive customer acquisition and expedite product innovation following rapid growth and industry validation. Earlier this year, Axonius was named RSA Conference’s “Most Innovative Startup 2019” for solving the asset management challenge, the security industry’s most fundamental, long-standing problem. While asset management has been a nagging, decades-old challenge, the simple, agentless approach by Axonius is being rapidly embraced by organizations worldwide.

Tel Aviv’s Axonius is the cybersecurity asset management platform that gives organizations a comprehensive asset inventory, uncovers security solution coverage gaps, and automatically validates and enforces security policies. Axonius is deployed in minutes, improving cyber hygiene immediately. (Axonius 27.08)

Back to Table of Contents

2.15 Music Education Startup JoyTunes Raises $25 Million

JoyTunes has completed a $25 million funding round. The round was led by Tel Aviv-based venture capital firm Qumra Capital with participation from existing investor New York-based venture capital and private equity firm Insight Venture Partners. The funding round brings JoyTunes’ total funding raised to date to $43 million, the company said.

The company intends to use the new round of funding to expand its product offering rather than expanding its team, Joytunes founder Yigal Kaminka said in a Monday interview with Calcalist. The funds will be used to advance the company and not to buy back employee shares, he added.

Founded in 2011, Tel Aviv’s JoyTunes develops apps that teach users how to play musical instruments. Simply Piano, JoyTunes’ signature app, shows users which piano keys to press to play the song of their choice. Through the microphone on the user’s phone or tablet, the company’s technology is able to recognize in real-time which sounds are played. Simply Piano has 25 courses for different skill levels and hundreds of different songs spanning multiple genres. The app has been downloaded more than 10 million times and JoyTunes now has more than 200,000 paying subscribers, surpassing $20 million in annual revenues. (JoyTunes 28.08)

Back to Table of Contents

2.16 Intel Lays Cornerstone for Mobileye’s New Global Development Center in Jerusalem

Mobileye President and CEO Prof. Shashua and Israeli Prime Minister Netanyahu laid the cornerstone for Mobileye’s new global development center in Jerusalem on 27 August. They were joined by Israel Economy Minister Cohen and Jerusalem Mayor Lion. When complete, the eight-story complex will span 50,000 square meters above ground and 78,000 square meters below ground and provide work space for as many as 2,700 employees. It is scheduled to open in 2022. Intel, a leader in the semiconductor industry, is shaping the data-centric future with computing and communications technology that is the foundation of the world’s innovations.

Mobileye, a developer of cutting-edge autonomous driving tech and advanced driver assistance systems, was acquired by chipmaker giant Intel in March 2017 for $15.3 billion, marking the largest acquisition of an Israeli company to date. Chinese tech giant Baidu announced it was teaming with Intel to integrate Jerusalem-based Mobileye tech into its autonomous vehicle platform in July 2018. In October 2018, German auto giant Volkswagen joined forces with Mobileye to deploy Israel’s first driverless, electric ride-sharing service. (Intel 29.08)

Back to Table of Contents

2.17 Israel’s F2 Capital is Raising $75 Million to Invest in Homegrown Startups

Israel’s first pre-seed technology accelerator, F2 Capital, is raising a $75 million fund to invest in Israel-based startups, according to an SEC-filing. So far the accelerator has raised around $55 million for the fund. F2 Capital was spun out of Genesis Partners, another Israeli venture firm, in 2016. F2 Capital took with them Genesis Partners’ pre-seed program: The Junction. The firm, taking on the role of accelerator as well, offers guidance, networks, and $100,000 in capital to each startup that joins the program. It has coached over 5,000 alumni and over $500 million has been raised by the startups born out of it. F2 Capital’s business partners include Deloitte, Facebook, Amazon Web Services (AWS) and Google Cloud Platform. F2 Capital’s fund raising shows that despite late-stage sector activity in Tel Aviv, early seeds are also being planted. (F2 Capital 27.08)

Back to Table of Contents

2.18 Yissum Wins Bid to Host Largest International Technology Transfer Conference in 2019

Yissum announced its selection as the host of AUTM ASIA 2019, the largest international conference for technology transfer experts and related professionals. The conference, which will be co-hosted by the Israel Technology Transfer Network (ITTN) will take place in Jerusalem, Israel on 4 – 7 November 2019, bringing together hundreds of academics, government and industry experts from across the globe to discuss the most important and current issues in Technology Transfer.

The announcement of the conference coincides with the publication of ITTN’s 2018 annual report showing the collective impact of the Technology Transfer sector in Israel. In 2018, Israeli tech transfer organizations (TTOs) evaluated 1,000 new innovations and filed over 620 new patents. In 2018, ITTN member organizations, which include universities, research institutions, hospitals, and HMOs, launched 74 spinoff companies, produced over 1,000 sponsored research and consulting agreements and hundreds of new license agreements. The most active sectors for Israeli TTO’s were pharma and biotech, accounting for some 40% of activity, followed by MedTech.

Yissum is the technology transfer company of The Hebrew University of Jerusalem. Founded in 1964, it serves as a bridge between cutting-edge academic research and a global community of entrepreneurs, investors, and industry. Yissum’s mission is to benefit society by converting extraordinary innovations and transformational technologies into commercial solutions that address our most urgent global challenges. (Yissum 03.09)

Back to Table of Contents

3: REGIONAL PRIVATE SECTOR NEWS

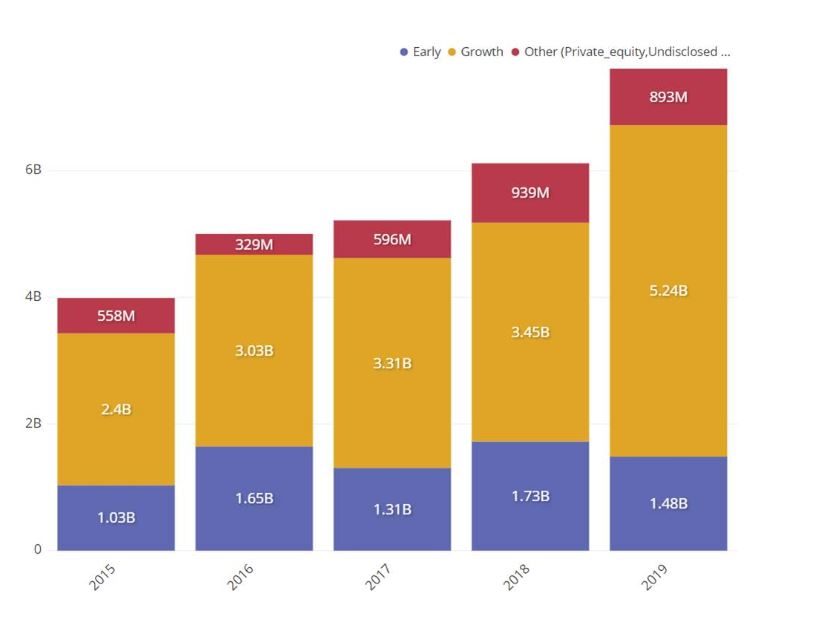

3.1 The Rise of Venture Capital Funding in Jordan

Much of the Arab Middle East’s VC investment growth has come from Jordan. The Hashemite Kingdom, which represents roughly 2% of the region’s population, accounted for 8% of startup investments last year — registering an increase that was second only to Egypt. Amman’s Oasis500 fund was among the most active investors with between seven and eight disclosed deals in 2018 alone.

It has been observed that none of this growth would be possible without Jordan’s vibrant entrepreneurial ecosystem. When a team worked with the American University of Beirut to design a Growth Readiness Program for small- and medium-sized enterprises, they found no shortage of firms to compete for a spot in the challenging, 12-week course. Still, despite a robust effort to reach them through outreach programs and countrywide boot-camps, many of Jordan’s best ideas may not get on the radar of its more prominent funds.

USAID JCP, working with the Companies Control Department at Jordan’s Ministry of Industry, Trade & Supply, has been working hard to put in place new regulations to attract venture capital investors to the country. Those efforts reached a peak on 27 December 2018, when the country’s official Gazette published new regulations operationalizing the 2018 Venture Capital Law. USAID assisted in developing the new law, its support pushing through the regulations. The new regulations now allow the establishment of VC funds in Jordan, bringing them in line with international best practice in governance, taxation, and a full range of support services. One of the primary objectives of the new regulations is to make that framework more familiar to international fund managers, lawyers, and other service providers who work with venture capital funds — thus lowering barriers to entry in the Jordan market. (MAGNiTT 29.08)

Back to Table of Contents

3.2 SINC Raises $250,000 in a Pre-Seed Funding Round

SINC, a Bahrain based Software-as-a-Service (SaaS) mobile platform that simplifies the management of a mobile workforce by operating timesheets, location tracking, staff scheduling, and job tracking, has raised $250,000 in a pre-seed funding round led by Dubai Angel Investors and other prominent regional angel investors. The funds will be used in the short-term to expand SINC’s development team and build out the job tracking functionalities that small businesses in North America desperately need.

One of the main problems facing blue-collar small and medium sized enterprises (SMEs) is that with labor costs growing exponentially compared to revenue, the accurate analysis of such data can be difficult and traditional timesheets may result in employers overpaying staff. Overcoming such issues, the SINC mobile app or web platform improves the reporting on staff tardiness and no-shows, as well as improving productivity and accountability with job costing analysis capabilities being placed at employer’s fingertips. Additionally, the application reduces payroll administration time by 98% and reduces payroll costs by 10-15%. SINC is built with mobility and convenience in mind as the mobile app allows human resources management and staff to undertake their in-office functions on-the-go.

SINC has ambitious targets, looking to initially expand its presence and customer base across North America, targeting a sizeable portion of the estimated 1.5 million small blue-collar businesses in that geography. The company then seeks to develop tailor-made solutions for the ever-growing and unique labor environment in the MENA region. (SINC 28.08)

Back to Table of Contents

3.3 The Importance of Fashion to the UAE’s Retail Market

The value of clothing sales in the UAE amounted to $12.3 billion in 2018, registering an annual growth rate of about 4.8%, according to new analysis released by Dubai Chamber of Commerce and Industry. The research also said the apparel retail sector is expected to see stronger performance over the 2019-2023 period. The analysis, based on recent data from Euromonitor International, described the apparel market as a major segment and key contributor to the UAE’s retail sector. It said global fashion brands still view the country as a preferred entry point for establishing their presence in the MENA region.

The analysis identified menswear as the top-performing category with the segment accounting for $6.2 billion worth of sales last year (53%), followed by womenswear with 34% and children’s apparel (7%). It added that the outlook for UAE apparel sales is expected to improve over the next five years as economic conditions become more favorable and consumer confidence strengthens. The research also said that online retail sales are witnessing strong growth, a trend expected to put pressure on prices.

Menswear is expected to register a compound annual growth rate (CAGR) of about 3.8% between 2019 and 2023 to reach $7.8 billion in 2023 while womenswear is expected to see a CAGR of 4.9% in sales over the same period to reach $5.2 billion in 2023, largely driven by stable footfall and an increasing in spend on modest fashion. Meanwhile, children’s apparel sales are projected to register a CAGR of 3.7% over the 2019-2023 period to reach $1 billion by 2023. (AB 23.08)

Back to Table of Contents

3.4 Five UAE Fintech Start-Ups Graduate from Emirates NBD’s Program

Five financial technology (FinTech) start-ups have become the first to graduate from a Sandbox testing platform. The Sandbox program is run by Emirates NDB, in collaboration with the largest financial technology accelerator in the Middle East, Africa and South Asia, the DIFC FinTech Hive. The two financial institutions have been working together to help startups integrate their technologies with an API (application programming interface) sandbox set up by Emirates NDB. These APIs allow developers to access over 200 of Emirates NDB’s APIs and 500 other endpoints covering retail, corporate and SME customers, along with over five million simulated customer transactions. The five startups that graduated were:

-Monimove, a digital trade finance firm

-Norbloc, a shared KYC (know your customer) system using blockchain

-Gamechanger, a keyboard banking system

-Bankbuddy, a chatbot for the finance industry

-Leap FinTech, a digital onboarding program for SMEs

The API Sandbox, launched by Emirates NBD Future Lab in 2018, is a first in the region, marking a significant landmark in the bank’s AED1 billion digital transformation program. (Emirates NDB 22.08)

Back to Table of Contents

3.5 UAE’s Group 42 Invests $65 Million in Chinese eCommerce Platform Jollychic

Jollychic, a Chinese cross-border ecommerce platform focused on the Middle East, has secured $65 million from UAE tech giant Group 42 in a series C+ funding round. Group 42, which is behind several national strategic tech projects in the region, considered Jollychic’s potential and position in the Middle East and its vision of building an ecommerce-based internet ecosystem for the investment. Jollychic said it plans to use the fresh funds to expand its segmentation, improve its logistics system, and develop third-party payment options and e-wallets. The funding will also help the company further strengthen its localization efforts.

Its payment platform, JollyPay, recently received relevant licenses in the UAE and online payment service qualification in Saudi Arabia. The development will help Jollychic with its goal to build an ecommerce ecology and “no cash society” in the Middle East. (TechInAsia 08.08)

Back to Table of Contents

3.6 Saudi Arabia’s Nana Direct Raises $6.6 Million for Expansion

Middle East Venture Partners (MEVP) and Impact46 have co-led an investment round in Riyadh based Nana Direct, an online grocery platform serving 13 cities across the Saudi kingdom. Other investors in the round, which raised $6.6 million, included Watar Partners, Saudi Venture Capital (SVC) Company and Wamda Capital.

Nana, a mobile-only company, said it aiming to transform the traditional supermarket experience and gain traction all over the Gulf kingdom. It added that it is in advanced stages of onboarding new stores and supermarkets to offer greater availability to users. It will use the new capital to accelerate its growth plans, continue to build its team and further develop vendor relations. (AB 20.08)

Back to Table of Contents

3.7 NowPay Closes $600,000 Seed Round from Silicon Valley’s Endure Capital & 500 Startups

NowPay, a Cairo-based fintech startup has raised $600,000 in a SEED funding round. Investors included Silicon Valley’s Endure Capital and 500 Startups. Founded in 2018, NowPay commits itself to helping employees get their salaries in advance whenever they apply for it during the month. A simple process that requires the employees to log into NowPay’s application through their account and enter the advance amount which they require. The account by this point will already be verified by the employer himself and the employees would be able to get their requested amount within a day or two. In order to rescue employees from financial stress and other relevant worries, it is essential that the employees feel that they can get their salaries whenever they are out of cash. The scheme that defines NowPay can help employees better manage their budgets and overcome cash flow problems thereby avoid any unnecessary tensions.

The application offers additional features such as allowing the user to see their salary status, salary details, account balance and maximum load that they can request, on the application. NowPay is at the forefront of revolutionizing the corporate culture in Egypt that seeks to harmonize the interoperability of the employers and the employees. (NowPay 29.08)

Back to Table of Contents

3.8 Egypt & Bombardier Agree to Build Two Monorails

On 5 August, Egypt’s Ministry of Transportation signed a contract with Quebec’s Bombardier Transportation to build two monorails, linking the Sixth of October City with Giza, and Nasr City with the New Administrative Capital. Bombardier was selected to establish a €3 billion monorail project in Egypt in May. Bombardier will deliver the project in partnership with two Egyptian companies Orascom Construction and the Arab Contractors. (DNE 05.08)

Back to Table of Contents

3.9 Chefaa Closes Significant Seed Funding Round

E-health startup Chefaa has closed a six-figure US dollar seed funding round from Flat6Labs and 500 Startups as it plans geographic expansion and the rollout of more products. Chefaa received pre-seed funding from Flat6labs Cairo in 2018, as well as a social impact grant from the StartEgypt initiative, and has now closed its seed round. The undisclosed investment, which Disrupt Africa has been told is a six-figure US dollar amount, comes from Flat6Labs and 500 Startups, and will be used to help the startup expand both geographically and in terms of its product offering.

They currently serve nine Egyptian cities, including Delta and Upper Egypt, and plan to cover Egypt totally by the end of this year. They will start expansion plans to the Gulf Cooperation Council (GCC) region by the end of this year as well. Chefaa is free to use for patients, with the startup charging pharmacies a commission fee on transactions and a monthly subscription fee in case of scheduled monthly packages for chronic patients. It also charges monthly subscription fees to medical and pharmaceutical organizations in return for access to insights.

Founded in May 2017, Cairo’s Chefaa helps patients make scheduled medicine orders in a bid to tackle challenges with accessing medication in a timely fashion. Chefaa is a vision-driven company to help patients order/schedule & have medicine delivered from nearest pharmacy according to GPS location with the easiest user trip. Locate medicine in a click by their real-time search engine. Their services extend to non-pharmaceuticals via their e-commerce Marketplace to be one-stop shop, using AI technology. Chefaa is HIPAA compliant. (Disrupt Africa 18.08)

Back to Table of Contents

3.10 Egypt’s Harmonica Acquired by Dallas’ Match Group

Egypt-based Harmonica, a seed-stage startup that offers mobile matchmaking with a large presence in the Middle East and other countries with a large Muslim population, has been acquired by international dating giant Match Group. The Dallas, Texas based acquirer is the holding company of Tinder, OkCupid and Match.com, among others. After the acquisition, 12 full-time employees from Harmonica are joining Match Group to help it serve the Muslim demographic globally.

Harmonica was founded in April 2017 by four Egyptian entrepreneurs who wanted to use technology to enhance the matchmaking process in a traditionally acceptable manner. The idea came out of personal experience, and the belief that technology could improve this process and facilitate meaningful relationships, as well as empower singles to meet their future life partners.

Match group with a market cap of over $20 billion, is ranked from the world’s top 20 digital companies according to Forbes. The investment in Harmonica follows Match Group’s April 2019 reorganization of its international leadership team to double down on the market opportunities for products in Asia, which includes many countries that are predominantly Muslim. Harmonica will remain headquartered in Cairo; this will be Match Group’s first office in the Middle East. (MAGNiTT 07.08)

Back to Table of Contents

3.11 Trella Joins Y Combinator’s S19 Batch

Trella announced that it has joined Y Combinator’s S19 batch. Joining the network of the globe’s top startups further validates Trella’s commitment to digitizing trucking and offering a grade-A end-to-end solutions to both shippers and carriers in the trucking industry. Mountain View, California’s YC opens the door for invaluable opportunities for synergies and collaboration with fellow YC companies and alumni, as well as unparalleled access to YC’s network of investors, mentors, and partners

Addressing an enormous pain-point in a deeply fragmented industry plagued by asset under-utilization and a lack of transparency, consistency, and reliability, Trella’s tech platform has already piqued the interests of regional and global investors and businesses. Earlier this year, Trella raised $600k+ in a pre-seed funding round led by Algebra Ventures, with participation from strategic investors, global VCs, and notable angel investors including Esther Dyson and Jambu Palaniappan.

Cairo’s Trella is a platform that connects shippers to carriers. Trella offers services and technology to empower drivers, improve their efficiency, boost their earnings and utilization as well as creating job opportunities. Trella aims to reduce costs for shippers, introduce a transparent pricing structure and provide them with a more reliable source of carriers. All the while allowing them to track their shipments in real-time as well as report key insights on their transportation trends and performance. (Trella 18.08)

Back to Table of Contents

3.12 Egypt’s Wholesale and Retail Food Market in 2019

The “Wholesale and Retail Food in Egypt 2019” report has been added to ResearchAndMarkets.com‘s offering. The wholesale and retail of food in Egypt has been under pressure since the floating of the Egyptian pound in 2016 which drove up inflation and put pressure on import prices. This was coupled with the introduction of value-added tax and the withdrawal of several fuel and food subsidies. Over-crowding, lack of parking facilities and out-of-stock situations are all commonplace experiences for shoppers.

However, there is long-term growth potential given that on average Egyptians spend 35% of their income on food, and more than 40% of the population are under 30, the generation widely regarded as most likely to understand the benefits of the one-stop approach to shopping.

Egypt’s food retail sector is fragmented and dominated by small, traditional, grocery retailers, whose 115,000 outlets account for 98% of the nearly 119,000 stores in the country and 80% of sales. The growing formal sector of modern supermarkets, hypermarkets and convenience stores makes up the remaining 2% comprising 1,500 outlets and representing around 20% of total sales. It is dominated by five major retailers. The modern grocery retail market is forecast to double between 2017 and 2021. Among leading retail outlets, UAE-based Majid Al Futtaim holds the Carrefour franchise in Egypt, and there are growing local and regional chains such as Metro and Spinneys. (RAM 07.08)

Back to Table of Contents

3.13 ADTRAN to Invest in Egypt to Create a Better Broadband Experience

Huntsville, Alabama’s ADTRAN, a leading provider of next-generation open networking and subscriber experience solutions, announced an agreement with the Arab Organization for Industrialization (AOI) to work on a joint manufacturing program in Egypt to deliver ADTRAN’s market-leading fiber products for Egypt and the region. A signing ceremony was held today at the AOI headquarters and was attended by executives from both companies, leading network operators, government ministers and industry leaders.

As part of an initial focus, the team will work on ADTRAN’s fiber access portfolio, including its award-winning XGS-PON, GPON and other SD-Access solutions. AOI is a leading manufacturer in the region and partners with companies in a diverse range of fields including electronics, renewable energy, automotive and aeronautics. (ADTRAN 19.08)

Back to Table of Contents

4: CLEAN TECH & ENVIRONMENTAL DEVELOPMENTS

4.1 Vertical Field Launches Study on the Impacts of “Smart Living Walls”

Vertical Field announced the launch of the world’s largest ever research study on the impact of “Smart Living Walls” in urban settings in terms of the environment, human health and wellbeing. The long-term research study, led by Professor Itamar Lensky and colleagues from Bar-Ilan University (BIU), the Agricultural Research Organization, and the Hebrew University of Jerusalem, together with Vertical Field, will take place over a number of years, and will monitor and analyze a range of scientific parameters pertaining to living walls, such as CO2 footprint reduction, heat reduction, impact on air quality, health impact assessment, economic benefits evaluation, establishment of winning economic models, and other aspects. The research aims to alleviate and minimize the adverse effects of rapid urbanization and increased building density on the environment, as well their impact on human health in an urban ecosystem.

The research is supported by the Israeli Science Foundation and the Ministry of Science, Technology and Space. It also integrates innovative solutions from Environmental Resources Management (EnviroManager), Israel’s largest private company engaged in continuous environmental monitoring, and from Netafim, a global manufacturer of irrigation equipment.

Ramat HaShavim’s Vertical Field is a leading provider of natural smart living wall solutions for urban environments and smart cities. The company is operated by professionals in the field of agricultural technology, enabling the development of smart walls that combine the best of design and manufacturing, smart computerized monitoring, soil-based technology, water technology and more. (Vertical Field 22.08)

Back to Table of Contents

4.2 Israel’s Ashalim Solar Thermal Power Station Begins Operations

Shikun & Binui Group announced the start of the commercial operation of Ashalim Solar Thermal Power Station, the largest renewable energy project in Israel and one of the largest in the world. In recent months, the plant has begun to generate electricity and is now supplying renewable energy to the national electricity grid that meets the consumption needs of an estimated 70,000 households. The plant has been a significant contributor to the implementation of government policies as well as to the goals in connection with generating electricity from renewable energy.

Several months ago, when the plant was completed and connected to the national electricity grid, Negev Energy Co. obtained the necessary permits, including a permanent electricity production license from the Electricity Authority and the Ministry of Energy, and began the commercial operation of the solar thermal power plant in Ashalim for the duration of the franchise.

Negev Energy, a joint venture of Shikun & Binui Energy (50%), the Noy Infrastructure Fund (40%) and the Spanish firm TSK (10%), won the tender that had been issued by the Accountant General at the Ministry of Finance and entered into a design franchise agreement in 2013, for the planning, design, financing, construction, operation and maintenance of a 121 MW thermo-solar plant for a period of 25 years. The 988-acre plant is composed of some 16,000 parabolic troughs and about half a million concave mirrors, which converts solar energy into steam that is then used to generate electricity. The Negev Energy Power Station has a unique system for storing thermal energy, based on molten salt, which allows the plant to operate for approximately an extra 4.5 hours daily at full power following sunset, maximizing the plant’s efficacy and efficiency. The investment in the construction of the plant is estimated to be about NIS 4 billion. Hundreds of workers, sub-constructors and suppliers, most of them residents of south Israel and the Negev region, took part in the construction of the plant. (Shikun & Binui 03.09)

Back to Table of Contents

4.3 Israel to Invest NIS 30 Million in New Plastic Recycling Technologies

The Israel Innovation Authority has approved the establishment of a new consortium aimed at promoting the development of recycling technologies, and the use of recycled materials in Israel’s plastics industry. Set to receive an investment of 30 million (around $8,600,000), the CIRCLE consortium will enable companies in the recycling sector or plastic and polymer manufacturers, as well as academic and research institutes in the field to develop innovative technologies to give Israeli industry an edge in international markets. The technologies developed in the consortium will allow for the expansion of the range of recycled materials and their applications.

The consortium’s establishment is aimed at leveraging Israel’s academic and industrial capabilities in order to close the existing technological gap and situate Israel’s plastics industry as a leader in the field of plastic waste management. It will operate within Israel Innovation Authority’s MAGNET consortium, a nonprofit association of industrial firms and academic research institutes for the research and development of cutting-edge technologies. (IH 13.08)

Back to Table of Contents

4.4 Jordan Sees Clean Energy to Cover 20% of its Power Needs by 2022

Jordanian Energy Minister Zawati said on 27 August, at the sixth international and fifth Arab forum on renewable energy, that Jordan has developed a legislative environment that has facilitated the creation of renewable wind and solar energy projects, providing “clean electricity” to the national grid at a current capacity of 1,200 megawatts. This figure constituted 12% of electricity generated in the Hashemite Kingdom in 2018. Clean energy sources are expected to contribute 20% of Jordan’s electricity needs by 2022, compared with 1% in 2014, according to Zawati. The value of renewable energy investments has exceeded the $4 billion mark. The ministry is preparing a “long-term strategy” for the energy sector to last up to the year 2030, Zawati said, pointing to the ministry’s vision for the year 2050, which is to be shared with institutions from the private and public sectors.

The strategy boasts four key pillars, which include reducing the import of energy, boosting reliance on locally produced renewable energy, achieving energy security and diversifying its sources as well as slashing energy costs. The minister highlighted Jordan’s efforts, through cooperation with neighboring countries, towards enhancing the connection between the Kingdom’s grid and those of stakeholder nations, allowing for the exchange of energy, especially renewable energy. (JT 27.08)

Back to Table of Contents

4.5 Bahrain Bans Sand Dredging in Order to Repair Seabed

Bahrain has banned the extracting and dredging of sand, in a bid to allow the kingdom’s seabed to recover from decades of damage. The order was announced by Bahraini Prime Minister Prince Khalifa bin Salman Al Khalifa on 31 August and was welcomed by fishermen and environmentalists.

Sand dredging and extraction cuts large chunks of the seabed without any differentiation or thought to its importance to the marine cycle. The operations stir up the seabed, causing irreparable damage to the marine environment over long distances; this worsens when there are strong currents. The order focuses on the seabed area north of Muharraq and around the Jarradah island, the report said. (AB 01.09)

Back to Table of Contents

4.6 Oman’s Dhofar Wind Farm Produces First Kilowatt Hour of Electricity

The 50-megawatt (MW) Dhofar Wind Farm in Oman has produced its first kilowatt hour of electricity, marking a major milestone for the GCC region’s first utility-scale wind farm. The landmark wind farm, which is fully funded by the Abu Dhabi Fund for Development (ADFD), was successfully connected to Oman’s electricity transmission grid in August during the commissioning of the project’s first wind turbine, which is now supplying clean power. The remaining 12 wind turbines will be commissioned, tested and connected to the grid in sequence, ensuring the start of commercial operations before the end of 2019. The project is being implemented by Abu Dhabi Future Energy Company (Masdar) through an EPC consortium of GE Renewable Energy and Spain’s TSK. Once fully commissioned, the wind farm is expected to generate enough electricity to supply 16,000 homes – equivalent to 7% of Dhofar Governorate’s total power demand – and will offset an estimated 110,000 tonnes of carbon dioxide emissions annually, while reducing reliance on natural gas for domestic power generation.

The Oman Power and Water Procurement Company (OPWP) will be the purchaser of the generated power, from the Rural Areas Electricity Company of Oman (Tanweer), which is responsible for operating the wind power plant upon completion. GE Renewable Energy has provided the project’s 3.8MW wind turbines, which have been built to withstand Oman’s hot and arid desert conditions, while TSK is responsible for the remainder of the wind farm’s infrastructure and electrical transmission facilities connecting the plant to the grid. (KT 14.08)

Back to Table of Contents

5: ARAB STATE DEVELOPMENTS

5.1 Lebanon’s Annual Average Inflation Rate Stands at 3% in July 2019

According to the Central Administration of Statistics (CAS), Lebanon’s average consumer prices rose by an annual 3% in the first seven months of 2019, compared to an annual rise of 6.23% recorded by July 2018. The increase in prices over the period came on the back of yearly rises registered across all components of the consumer price index (CPI), except Transportation and Health. The breakdown of the CPI revealed that the average costs of Housing and utilities (including: water, electricity, gas and other fuels) which grasped a combined 28.4% of the CPI, climbed by an annual 2.65% by July 2019. Average Owner-occupied rental costs (constituting 13.6% of the category) grew by an annual 2.64%. In turn, the average prices of water, electricity, gas, and other fuels (11.8% of housing & utilities) recorded a yearly uptick of 2.54% over the same period. Moreover, the average prices for Food and non-alcoholic beverages (20% of the CPI) and Education costs (6.6% of CPI) registered yearly upticks of 4.85% and 5.14%, respectively, by July 2019. As for the average prices of Clothing and Footwear (5.2% of the CPI), they also rose by 14.55% year-on-year (y-o-y) by July 2017. Meanwhile, average consumer prices of Health (7.7% of the CPI) and Transportation (13.1% of the CPI) recorded the respective downticks of 0.80%YOY and 0.96% YOY. The latter slipped mainly due to the decline in average oil prices which slipped by an annual 8.16% to $65.87/barrel by July 2019. (CAS 21.08)

Back to Table of Contents

5.2 Lebanon’s Trade Deficit Ended at $8.04 Billion in First Half of 2019

Lebanon’s trade deficit widened in the first 6 months of the year to reach $8.41B, up by 4.58% compared to the same period in 2018. Regardless of the promising progress in exports, which grew by a yearly 12.38% to $1.73B, the wider deficit came as a result of a 5.83% yearly increase in the value of imports to $10.14B, noting that Mineral products and Vegetable products are the only 2 categories to witness an increase in its imported value.

In terms of value, Mineral products were the leading imports to Lebanon by June 2019, grasping a 33.24% stake of total imported goods. Products of the chemical or allied industries followed, constituting 10.15% of the total, while machinery and electrical instruments grasped 8.99% of the total. Specifically, Lebanon imported $3.37B worth of Mineral Products, compared to a value of 1.64B in the same period last year. In fact, the net weight of imported mineral fuels, oils and their products witnessed a yearly increase from 2,707,439 tons by June 2018 to reach 6,008,753 tons by June 2019, the highest volume in more than 10 years. The increase in volume is mainly due to the smuggling to Syria amid the rationing of oil in the country, as the Syrian Government is trying to limit capital outflows from the country. Meanwhile, the value of chemical or allied industries recorded a decrease of 9.47% y-o-y to settle at $1.02B and that of machinery and electrical instruments also declined by 14.87% over the same period to $911.74M.

In terms of top trade partners, Lebanon primarily imported from US, China, and Russia with shares of 9.08%, 8.60% and 6.92%, respectively, by June 2019. As for exports, the top category of products exported from Lebanon were pearls, precious stones and metals, which grasped a share of 32.88% of total exports, followed by a share of 11.57% for prepared foodstuffs, beverage, and tobacco and 10.74% for Machinery; electrical instruments over the same period. The value of pearls, precious stones & metals surged by 43.88% by June 2019 to reach $568.92M. As for the value of Prepared foodstuffs; beverages, tobacco, it declined by 3.96% y-o-y to $200.15M. Meanwhile, the value of Machinery; electrical instruments recorded an important increase of 22.95% year-on-year to $185.90M. In H1/19, Switzerland followed by the UAE and Saudi Arabia were Lebanon’s top three export destinations, respectively constituting 19.08%, 12.94%, and 6.72% of total exports. (Blom 26.08)

Back to Table of Contents

5.3 Jordan’s Average Inflation Rate for July 2019 Rises by 0.2%

The monthly report on inflation in Jordan issued by the Department of Statistics indicates that the Consumer Price Average (Inflation) reached 125.55 in July 2019 against 125.30 during the same month of 2018, recorded an increase by 0.2%. The main commodities groups, which contributed to this increase, were Rents by 0.51%, Meat & poultry by 0.35%, Cereals and its products by 0.12%, Education by 0.07% and Culture & Recreation by 0.06%. Meanwhile, the main commodities groups which witnessed a decrease in their prices were Transport by 0.38%, Dairy and its products and eggs by 0.16%, fuel and lighting by 0.13% and Tobacco and Cigarettes by 0.15%.

On the monthly level, the Consumer Price index for July 2019 has decreased by 0.1% compared with the previous month (June) 2019. The main commodities groups which contributed to this decrease were Meat & poultry by 0.15%, Transport by 0.18%, Fruits & Nuts by 0.04% and Sugar and its products and Fuel & lighting by 0.02% for each. Meanwhile, the main groups which witnessed an increase in their prices were Dairy and its products and eggs by 0.12%, Vegetables, Dried and Canned Legumes by 0.11%, Beverages by 0.03% and Oil & fats by 0.02%. (DoS 19.08)

Back to Table of Contents

5.4 Jordanian Unemployment Continues to Rise Unabated

The Hashemite Kingdom’s unemployment rate registered a 0.5% increase at the end of this year’s second quarter, currently standing at 19.2%. In its quarterly unemployment report, the Department of Statistics (DoS) reported that the unemployment rate for men stood at 17%, compared with 17.2% for women, denoting increases of 0.5 and 0.4% respectively in comparison with the same period of last year.

Unemployment amongst university-degree holders also registered an increase, standing at 25.9%. The unemployment rate for those who have completed their secondary education or beyond amounted to 56%, compared with 44% for those with a lesser qualification. Unemployment was most prevalent among the 15-19 and 20-24 age groups, reaching 46 and 40% respectively. The DoS reported that 30% of men with a bachelor’s degree were unemployed, compared with 84% unemployment among their women counterparts. (DoS 02.09)

Back to Table of Contents

5.5 Chinese Company Signs $1.4 Billion Iraq Construction Deal

A Chinese company has reportedly signed a $1.39 billion construction contract in Iraq. According to Xinhua, China Construction Third Engineering Bureau will implement civil engineering projects and infrastructure in southern Iraq, including low-cost housing, education, medical centers and facilities projects in governorates of Najaf, Karbala and Basra. (Xinhua 08.08)

Back to Table of Contents

►►Arabian Gulf

5.6 Bahrain Says Budget Deficit Narrows to $1 Billion in First Half of 2019

Bahrain has announced it has narrowed its budget deficit to BD404 million ($1.07 billion) in the first half of 2019. The kingdom feels it is ahead of its projected deficit reduction schedule, after the deficit fell from BD650 million in the same period a year earlier.

Last month, a report from the Institute of Chartered Accountants in England and Wales (ICAEW) and Oxford Economics said Bahrain’s economic outlook for the remainder of 2019 remains “challenging” due to weakness in government finances, limited prospects for oil sector growth and a general slowdown in the non-oil economy. According to ICAEW’s report, economic growth in the kingdom more than halved last year from 3.7% in 2017 to 1.8 in 2018, with further deceleration seen in 2019 to 1.6%. ICAEW said it expects a range of measures to be taken to reduce the fiscal deficit from an estimated 10.1% of GDP in 2018 to around 7% of GDP in 2019. Bahrain, which does not benefit from the vast oil wealth of other Gulf Arab states, last year released a plan to fix its debt-burdened finances after securing a $10 billion Gulf aid pledge. (AB 07.08)

Back to Table of Contents

5.7 Trademark Infringements in Dubai Increase By 23% in First Half

There was a 23% increase in the number of trademark infringement cases brought in Dubai over the first half of the year. The Intellectual Property Protection section in Dubai Economy resolved 186 cases as opposed to 151 over the same period in 2018. Commercial agencies brought forward 16 cases of trademark infringement in the first six months of 2019, a 33% increase over H1/18. Among the cases, 38 were relating to cosmetics and 22 were about personal care products while the other brands involved were mostly perfumes (21 cases), clothes (14), gold and ornaments (13), phones and accessories (12), glasses (10), bags and leather products (7) and watches (6). It comes as the Commercial Compliance & Consumer Protection (CCCP) sector in Dubai Economy witnessed a 63% year-on-year increase in trademark files registered on its ‘IP Gateway’ portal during the first six months of 2019.

The top five source countries among the trademark files opened in the first six months of 2019 were: USA (1,482 files, representing 29% of the total); UAE (742 files, 14.8% of the total); Germany (325 files, or 7%); France (273 files, or 5.2%) and the UK (260 files, 5%). (AB 25.08)

Back to Table of Contents

5.8 UAE’s Third Nuclear Plant Hits Key Power Testing Milestone

The Emirates Nuclear Energy Corporation (ENEC) achieved another milestone in the construction of Unit 3 of the Barakah Nuclear Energy Plant, being built in the Al Dhafra region of Abu Dhabi. ENEC said it has safely and successfully energized Unit 3’s main power transformer and gas insulated bus, an important step in the continued testing and commissioning of the plant. Unit 3’s auxiliary power transformers and excitation transformer were also energized in normal operating configuration, ENEC said, adding that it comes approximately one year after the completion of similar work on Unit 2. Testing and commissioning teams will now begin preparing for the start of hot functional testing at Unit 3 which consists of almost 200 tests performed on major systems. The construction of the Barakah plant is progressing with Unit 1 complete, while Unit 2 stands at 95%, Unit 3 at 91%, and Unit 4 at 82%. Unit 1 is currently undergoing commissioning and testing, prior to regulatory review and receipt of the operating license from regulators. (AB 20.08)

Back to Table of Contents

5.9 UAE to Add Sugary Drinks and E-Cigarettes to Excise Tax List in 2020

On 20 August, the UAE Cabinet announced a decision to expand the list of excise taxable products to include sweetened beverages, sugary drinks and electronic smoking devices, starting from 1 January 2020. The decision to add a tax of 50% is part of efforts to reduce consumption of unhealthy goods and modify consumers’ behavior. The decision also requires manufacturers to clearly identify the sugar content in order for consumers to make “sensible healthy choices”. A tax of 100% will be levied on electronic smoking devices, whether or not they contain nicotine or tobacco, as well as the liquids used in electronic smoking devices. The decision aims at reducing the consumption of harmful products that put the health of people and environment at risk. In 2017, the UAE Government started introducing excise tax on specific goods, which are typically harmful to human health or the environment. (AB 20.08)

Back to Table of Contents

5.10 Saudi Arabia Replaces Royal Court Chief and Creates Ministry of Industry